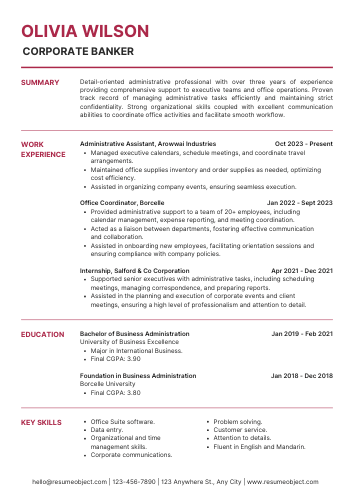

Corporate Banker Resume

In today's competitive job market, a standout corporate banker resume is essential for landing your dream position. Crafting a resume that highlights your skills in financial analysis, client relationship management, and risk assessment can set you apart from other candidates.

Utilizing a well-structured resume template can streamline the application process, ensuring you present your qualifications effectively. A sample format can guide you in showcasing your experience and achievements, making it easier for hiring managers to recognize your potential.

Corporate Banker Resume Objective Statement Examples

Explore effective corporate banker resume objective examples that highlight your financial expertise, strategic thinking, and client relationship skills, ensuring you stand out to potential employers in the competitive banking industry.

-

Results-driven Corporate Banker with over 5 years of experience in managing client portfolios and driving revenue growth, seeking to leverage expertise in financial analysis and relationship management to enhance client satisfaction and profitability.

-

Detail-oriented Corporate Banker aiming to utilize strong analytical skills and extensive knowledge of corporate finance to support strategic decision-making and deliver tailored financial solutions for clients in a dynamic banking environment.

-

Dynamic Corporate Banker with a proven track record in developing and executing financial strategies for corporate clients, looking to contribute to a forward-thinking bank by enhancing client engagement and expanding the service portfolio.

-

Client-focused Corporate Banker with expertise in credit risk assessment and loan structuring, seeking to join a reputable financial institution to provide exceptional service and innovative financing solutions to corporate clients.

-

Ambitious Corporate Banker with a strong background in market analysis and business development, eager to drive growth and foster long-term relationships with clients while delivering high-quality financial products and services.

For those looking to advance their nursing career, an effective resume is essential. Explore our comprehensive guide on crafting a standout Advice Nurse Resume to showcase your skills and experience.

Example Summary for Corporate Banker Resume

This section provides a concise example of a resume summary tailored for a Corporate Banker role, highlighting key skills, experiences, and achievements that demonstrate suitability for the position.

Detail-oriented and motivated recent finance graduate with a strong foundation in corporate banking principles and financial analysis. Proven ability to build relationships and communicate effectively with clients, complemented by internships in financial services. Adept at conducting market research and supporting loan underwriting processes. Eager to leverage analytical skills and a passion for finance to contribute to a dynamic corporate banking team.

Results-driven Corporate Banker with over 5 years of experience in providing tailored financial solutions to corporate clients. Proven track record in driving revenue growth, managing client relationships, and executing complex transactions. Skilled in credit analysis, risk assessment, and financial modeling, with a strong ability to identify opportunities for business development. Adept at collaborating with cross-functional teams to deliver exceptional client service and achieve organizational goals. Seeking to leverage expertise in a dynamic financial institution to enhance client portfolios and contribute to strategic growth initiatives.

Results-driven Corporate Banker with over 10 years of experience in financial services, specializing in corporate lending, risk assessment, and relationship management. Proven track record of developing and managing high-value client portfolios, delivering tailored financial solutions, and driving revenue growth. Exceptional analytical skills and a deep understanding of market trends, enabling informed decision-making and strategic planning. Adept at building strong relationships with clients and stakeholders, fostering trust and collaboration to achieve business objectives. Committed to leveraging expertise in financial analysis and credit assessment to support clients in achieving their financial goals while ensuring compliance with regulatory standards.

Similar Resumes

Key Job Duties & Responsibilities of Corporate Banker

Corporate bankers manage client relationships, assess financial needs, provide tailored banking solutions, analyze market trends, and ensure compliance, driving growth and profitability for both clients and the institution.

-

Client Relationship Management: Develop and maintain strong relationships with corporate clients to understand their financial needs and provide tailored banking solutions.

-

Financial Analysis: Conduct thorough financial assessments of corporate clients, analyzing their creditworthiness and financial health to make informed lending decisions.

-

Loan Structuring: Design and structure loan products that meet the specific requirements of clients while ensuring compliance with bank policies and regulations.

-

Risk Assessment: Identify and evaluate potential risks associated with lending to corporate clients, implementing strategies to mitigate these risks.

-

Market Research: Stay informed about market trends, economic conditions, and industry developments to provide clients with relevant insights and advice.

-

Cross-Selling Services: Promote additional banking products and services, such as treasury management, trade finance, and investment solutions, to enhance client relationships and drive revenue.

-

Collaboration with Internal Teams: Work closely with credit analysts, relationship managers, and other departments to ensure seamless service delivery and effective client support.

-

Compliance and Regulatory Adherence: Ensure all banking activities comply with local and international regulations, maintaining the integrity and reputation of the bank.

-

Client Presentations: Prepare and deliver presentations to clients, showcasing the bank’s offerings and how they align with the clients’ financial goals.

-

Performance Monitoring: Track and report on the performance of loan portfolios, making adjustments as necessary to optimize returns and manage risk.

-

Networking and Business Development: Actively participate in industry events and networking opportunities to build connections and identify potential new clients.

Important Sections to Add in Corporate Banker Resume

Highlighting key sections in a Corporate Banker resume is crucial for showcasing relevant skills, experience, and achievements. Essential components include a strong summary, professional experience, education, certifications, and skills tailored to the banking industry.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure this information is up-to-date and professional.

-

Professional Summary: Write a concise summary that highlights your experience, skills, and career objectives. Tailor it to reflect your expertise in corporate banking and your value to potential employers.

-

Core Competencies: List key skills relevant to corporate banking, such as financial analysis, risk management, client relationship management, and regulatory compliance. Use bullet points for easy readability.

-

Professional Experience: Detail your work history in reverse chronological order. For each position, include your job title, company name, location, and dates of employment. Use bullet points to describe your responsibilities and achievements, focusing on quantifiable results.

-

Education: Include your educational background, starting with the most recent degree. Mention the degree earned, institution name, and graduation date. If applicable, include relevant coursework or honors.

-

Certifications and Licenses: List any relevant certifications, such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP). Mention any licenses required for corporate banking.

-

Technical Skills: Highlight proficiency in financial software and tools, such as Excel, Bloomberg, or risk management systems. This section can set you apart from other candidates.

-

Professional Affiliations: Include memberships in relevant organizations, such as the Association for Financial Professionals (AFP) or other industry-related groups. This demonstrates your commitment to professional development.

-

Awards and Recognitions: If applicable, mention any awards or recognitions received in your career. This can enhance your credibility and showcase your accomplishments.

Required Skills for Corporate Banker Resume

When crafting your corporate banker resume, highlight essential skills that showcase your financial expertise, analytical abilities, and client relationship management. These will set you apart and demonstrate your readiness for the challenges of the role.

- Financial Analysis

- Credit Risk Assessment

- Relationship Management

- Loan Structuring

- Regulatory Compliance

- Portfolio Management

- Market Research

- Negotiation Skills

- Financial Modeling

- Client Acquisition

- Communication Skills

- Problem Solving

- Team Collaboration

- Time Management

- Strategic Planning

Action Verbs to Use in Corporate Banker Resume

Incorporating impactful action verbs in your corporate banker resume enhances its effectiveness, showcasing your skills and achievements. These dynamic words convey your contributions, drive, and leadership, making your application stand out to potential employers.

- Analyzed

- Coordinated

- Developed

- Enhanced

- Executed

- Facilitated

- Implemented

- Managed

- Negotiated

- Optimized

- Oversaw

- Prepared

- Researched

- Strategized

- Transformed

Entry-Level Corporate Banker Resume Sample

Looking to kickstart your career in corporate banking? Check out this sample entry-level corporate banker resume that highlights essential skills, education, and experience, helping you stand out to potential employers and land that dream job!

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented and motivated finance graduate seeking an entry-level Corporate Banker position at XYZ Bank to leverage analytical skills and financial knowledge to support corporate clients in achieving their financial goals.

Education

Bachelor of Science in Finance

University of ABC, City, State

Graduated: May 2023

- Relevant Coursework: Corporate Finance, Investment Analysis, Financial Markets, Risk Management

- Dean's List: Fall 2021, Spring 2022

Skills

- Financial Analysis

- Risk Assessment

- Client Relationship Management

- Microsoft Excel & Financial Modeling

- Strong Communication & Presentation Skills

- Knowledge of Banking Regulations

Experience

Intern, Corporate Banking Division

XYZ Bank, City, State

June 2022 – August 2022

- Assisted in analyzing financial statements and creditworthiness of corporate clients.

- Supported senior bankers in preparing loan proposals and presentations for potential clients.

- Conducted market research to identify trends and opportunities for corporate lending.

- Collaborated with cross-functional teams to streamline client onboarding processes.

Finance Tutor

University of ABC, City, State

September 2021 – May 2023

- Provided one-on-one tutoring sessions for undergraduate students in finance courses.

- Developed study materials and practice exams to enhance student understanding of complex financial concepts.

Certifications

- Bloomberg Market Concepts (BMC)

- Financial Modeling & Valuation Analyst (FMVA) - In Progress

Professional Affiliations

- Member, Finance Club, University of ABC

- Volunteer, Local Community Financial Literacy Program

References

Available upon request.

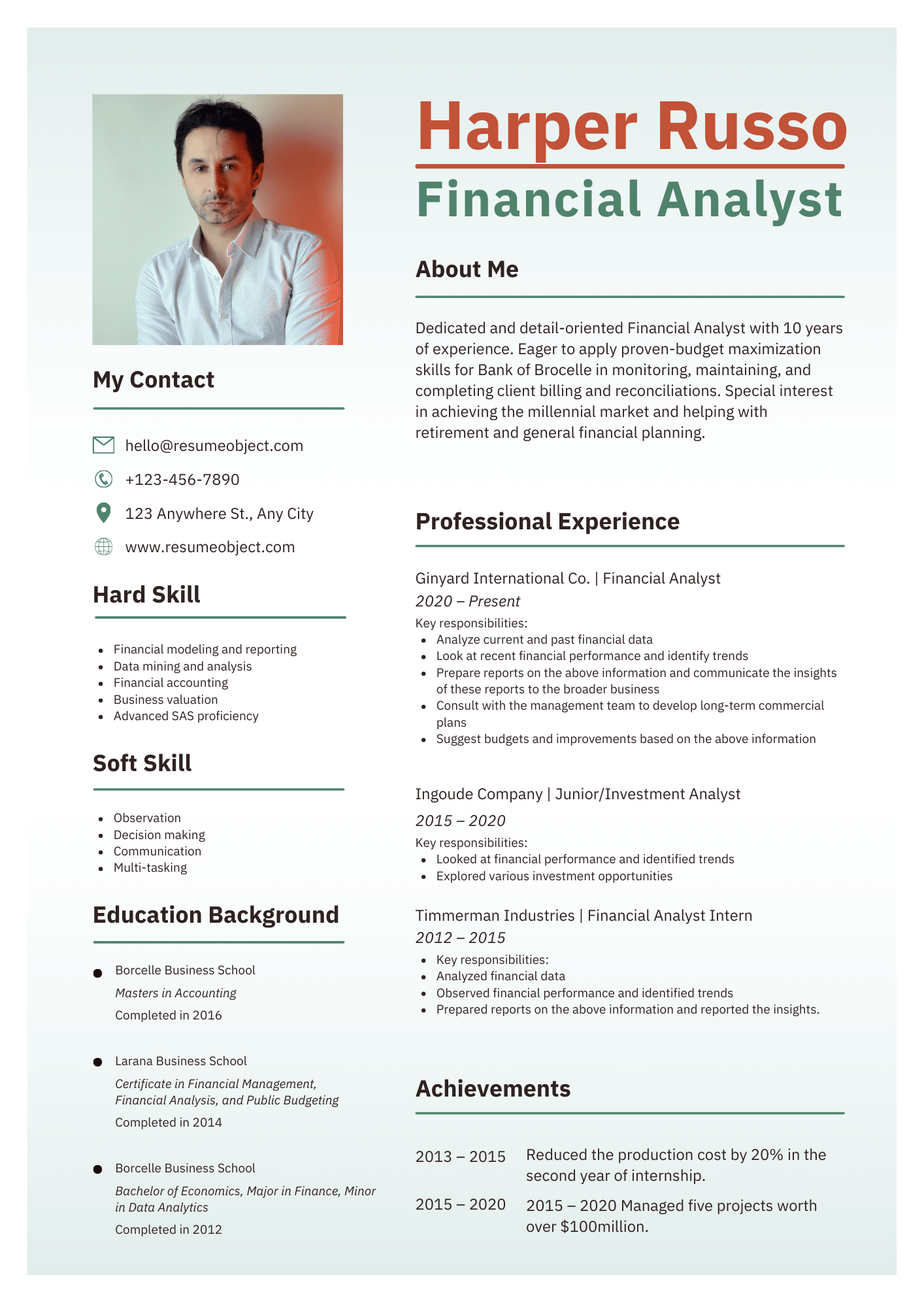

Corporate Banker Sample Resume (Mid-Level)

This sample mid-level corporate banker resume showcases essential skills, experience, and achievements tailored for the banking industry, highlighting expertise in financial analysis, client relationship management, and strategic decision-making to attract potential employers.

Sample Resume #2

Contact Information

John Doe

123 Banking St.

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Corporate Banker with over 5 years of experience in delivering tailored financial solutions to mid-sized and large corporations. Proven track record in relationship management, credit analysis, and risk assessment. Adept at identifying client needs and developing strategies to enhance profitability and growth.

Core Competencies

- Relationship Management

- Credit Analysis

- Financial Modeling

- Risk Assessment

- Market Research

- Negotiation Skills

- Regulatory Compliance

- Team Leadership

Professional Experience

Corporate Banker

ABC Bank, City, State

January 2020 - Present

- Managed a portfolio of over 50 corporate clients, providing financial solutions that align with their strategic objectives.

- Conducted thorough credit analyses and risk assessments, resulting in a 20% increase in loan approval rates.

- Developed and maintained strong client relationships, leading to a 30% increase in cross-selling opportunities.

- Collaborated with internal teams to create customized financial products that meet client needs.

Assistant Corporate Banker

XYZ Financial Services, City, State

June 2017 - December 2019

- Assisted senior bankers in managing client portfolios, ensuring timely follow-ups and communication.

- Conducted market research to identify potential clients and growth opportunities, contributing to a 15% increase in new business.

- Prepared financial presentations and reports for client meetings, enhancing client understanding of financial products.

- Supported compliance initiatives by ensuring adherence to regulatory standards and internal policies.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2017

Certifications

- Certified Corporate Banker (CCB)

- Financial Risk Manager (FRM)

Professional Affiliations

- Member, Association of Corporate Bankers

- Member, Financial Planning Association

References

Available upon request.

Corporate Banker Sample Resume for Experienced Level

Looking to land that senior-level corporate banking position? Check out our expertly crafted resume sample format, designed to showcase your extensive experience, leadership skills, and industry expertise in a way that captivates hiring managers.

Sample Resume #3

John Doe

123 Finance St.

New York, NY 10001

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Dynamic and results-oriented Corporate Banker with over 10 years of experience in managing corporate client relationships, providing tailored financial solutions, and driving revenue growth. Proven track record in credit analysis, risk management, and strategic financial planning. Adept at leading teams and collaborating with cross-functional departments to achieve organizational goals.

Professional Experience

Senior Corporate Banker

XYZ Bank, New York, NY

March 2018 – Present

- Managed a portfolio of over 50 corporate clients, achieving a 20% increase in revenue through tailored financial products and services.

- Conducted in-depth credit analyses and risk assessments, ensuring compliance with regulatory guidelines and minimizing default risks.

- Collaborated with relationship managers to develop strategic plans for client acquisition and retention, resulting in a 15% growth in new business.

- Led a team of junior bankers, providing mentorship and training on credit evaluation and client relationship management.

Corporate Banking Officer

ABC Financial Group, New York, NY

June 2014 – February 2018

- Developed and maintained strong relationships with key corporate clients, enhancing client satisfaction and loyalty.

- Structured and negotiated loan agreements, syndications, and other financial instruments to meet client needs.

- Conducted market research and analysis to identify new business opportunities, contributing to a 10% increase in market share.

- Assisted in the development of marketing strategies that improved brand visibility and client engagement.

Credit Analyst

DEF Bank, New York, NY

January 2012 – May 2014

- Analyzed financial statements and credit reports to assess client creditworthiness and recommend loan approvals.

- Prepared detailed credit memos and presentations for senior management, facilitating informed decision-making.

- Monitored loan performance and compliance, identifying potential risks and recommending mitigation strategies.

Education

Master of Business Administration (MBA)

Finance Concentration

Columbia University, New York, NY

Graduated: May 2011

Bachelor of Science in Finance

University of California, Berkeley, CA

Graduated: May 2009

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate

- Certified Treasury Professional (CTP)

Skills

- Corporate Finance

- Credit Risk Analysis

- Client Relationship Management

- Financial Modeling

- Team Leadership

- Strategic Planning

- Market Analysis

- Regulatory Compliance

Professional Affiliations

- Member, Association of Corporate Treasurers

- Member, Risk Management Association

References

Available upon request.

Resume Tips That Work for Corporate Banker Resume

Do

Do: Highlight your financial acumen by showcasing your expertise in analyzing financial statements and assessing credit risk to demonstrate your ability to make informed lending decisions.

Do: Emphasize client relationship management by detailing your experience in building and maintaining strong relationships with corporate clients, ensuring their needs are met and fostering long-term partnerships.

Do: Showcase your knowledge of regulatory compliance by mentioning your familiarity with financial regulations and your ability to ensure that all banking practices adhere to legal standards, mitigating risks for the institution.

Do: Demonstrate your ability to drive revenue growth by including examples of successful loan origination, cross-selling banking products, and developing strategies that have led to increased profitability for the bank.

Do: Include your teamwork and collaboration skills by illustrating your experience working with cross-functional teams to achieve corporate goals, highlighting your role in contributing to a cohesive and productive work environment.

Don't

Don't: Include irrelevant work experience. Focus on roles that highlight your skills in finance, banking, and client management.

Don't: Use jargon without context. Avoid industry-specific terms that may confuse readers; instead, use clear language that demonstrates your expertise.

Don't: Neglect quantifiable achievements. Always include specific metrics or accomplishments to showcase your contributions and impact in previous roles.

Don't: Overlook formatting and structure. Ensure your resume is clean, professional, and easy to read; a cluttered layout can detract from your qualifications.

Don't: Use an unprofessional email address. Choose a simple and professional email that reflects your commitment to professionalism in the banking industry.

Corporate Banker Sample Cover Letter

A Sample Corporate Banker Cover Letter provides a professional template highlighting key skills, experiences, and qualifications tailored for corporate banking roles, helping applicants effectively showcase their expertise and secure interviews in a competitive job market.

[Your Name]

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, Zip]

Dear [Hiring Manager's Name],

I am writing to express my interest in the Corporate Banker position at [Company Name] as advertised on [where you found the job listing]. With a solid background in financial analysis and a proven track record of building strong client relationships, I am excited about the opportunity to contribute to your team.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of corporate clients, providing tailored financial solutions that increased client satisfaction and retention. My ability to analyze market trends and assess risk has allowed me to make informed recommendations, driving growth and profitability for both the clients and the bank.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in corporate banking. I am eager to leverage my skills in relationship management and strategic planning to help your clients achieve their financial goals while enhancing your bank's reputation in the industry.

I would love the opportunity to discuss how my experience and vision align with the goals of [Company Name]. Thank you for considering my application. I look forward to the possibility of contributing to your esteemed organization.

Sincerely,

[Your Name]

FAQs about Corporate Banker Resume

What should be the primary objective on a corporate banker resume?

The primary objective on a corporate banker resume should be to highlight your expertise in financial analysis, relationship management, and strategic planning. Emphasize your ability to drive revenue growth, manage client portfolios, and deliver tailored financial solutions, showcasing your value to potential employers in the corporate banking sector.

How can entry-level corporate bankers effectively showcase their potential on a resume?

Entry-level corporate bankers can showcase their potential by highlighting relevant internships, academic achievements, and skills such as financial analysis, client relationship management, and teamwork. Use quantifiable results to demonstrate impact, tailor the resume to the job description, and include certifications or coursework related to finance and banking.

What are the key differences in resume format between mid-level and senior-level corporate bankers?

Mid-level corporate bankers typically use a chronological format highlighting relevant experience and skills, while senior-level bankers often adopt a more strategic format, emphasizing leadership roles, achievements, and industry impact. Senior resumes may also include a summary statement and focus on high-level competencies and contributions to organizational goals.

Which certifications are most beneficial to highlight on a corporate banker resume?

Highlight certifications such as Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), and Financial Risk Manager (FRM) on your corporate banker resume. These credentials demonstrate expertise in financial analysis, risk management, and investment strategies, making you a more attractive candidate to potential employers in the banking sector.

What are common mistakes to avoid when crafting a corporate banker resume?

Common mistakes to avoid when crafting a corporate banker resume include using generic templates, neglecting quantifiable achievements, and failing to tailor the resume to specific job descriptions. Additionally, avoid excessive jargon, lengthy paragraphs, and typos. Focus on clarity, relevance, and showcasing your unique value to potential employers.

Corporate Banker Resume

Objective

Results-driven Corporate Banker with over 5 years of experience in financial analysis and client relationship management, seeking to leverage expertise in driving growth and maximizing profitability for a leading financial institution.

Summary/Description

Results-driven Corporate Banker with over 10 years of experience in financial analysis, relationship management, and strategic lending. Proven track record in driving revenue growth and enhancing client satisfaction.

Top Required Skills

Financial Analysis

Risk Management

Relationship Management

Credit Assessment

Regulatory Compliance

Mistakes to Avoid

Lack of quantifiable achievements and metrics.

Generic language without industry-specific terminology.

Ignoring relevant skills like risk assessment and financial analysis.

Important Points to Add

Strong financial analysis and risk assessment skills

Proven track record of managing corporate client relationships

Expertise in structuring and negotiating complex financing solutions

View More Templates

Free Resume Templates

Free Resume Templates