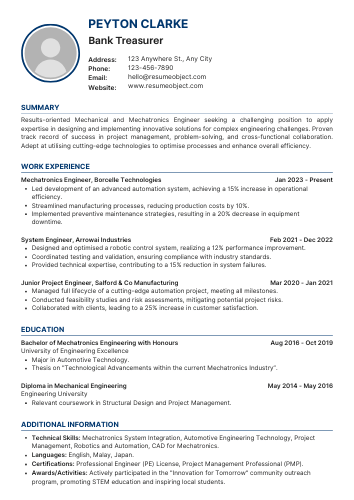

Bank Treasurer Resume

In today's competitive job market, a well-crafted Bank Treasurer resume is essential for standing out among candidates. Utilizing a professional resume template can help you highlight your financial expertise, leadership skills, and experience in treasury management effectively.

A strong resume format not only showcases your qualifications but also emphasizes your ability to manage cash flow and optimize investments. By following a proven sample format, you can create a compelling narrative that captures the attention of hiring managers in the banking sector.

Bank Treasurer Resume Objective Statement Examples

Explore effective bank treasurer resume objective examples that highlight financial expertise, leadership skills, and strategic vision, helping candidates stand out and secure desired positions in the competitive banking industry.

-

Results-driven banking professional with over 10 years of experience in treasury management, seeking to leverage expertise in liquidity management and risk assessment to optimize financial performance as a Bank Treasurer.

-

Detail-oriented finance expert aiming to utilize extensive knowledge in cash flow forecasting and investment strategies to enhance the treasury operations of a forward-thinking financial institution.

-

Dynamic treasury leader with a strong background in regulatory compliance and capital management, seeking to contribute to a bank's strategic goals by implementing innovative financial solutions and optimizing asset allocation.

-

Analytical finance professional looking to apply my skills in financial modeling and market analysis to drive profitability and improve treasury functions as a Bank Treasurer in a reputable banking organization.

-

Dedicated treasury specialist with a proven track record in managing banking relationships and optimizing funding strategies, eager to help a financial institution achieve its financial objectives and enhance operational efficiency.

Discover how to create an impactful HVAC Sales Engineer resume that highlights your skills and experience. Check out this comprehensive guide to elevate your job application: HVAC Sales Engineer Resume.

Example Summary for Bank Treasurer Resume

This section provides a concise example of a resume summary tailored for a Bank Treasurer position, highlighting key skills, experience, and qualifications that demonstrate suitability for the role.

Detail-oriented finance graduate with a strong foundation in accounting and financial management. Proven ability to analyze financial data and develop strategic plans to optimize cash flow and enhance profitability. Excellent communication and interpersonal skills, with a commitment to maintaining compliance and fostering positive relationships with stakeholders. Eager to leverage analytical skills and financial knowledge in an entry-level Bank Treasurer position to contribute to the financial stability and growth of the organization.

Results-driven Bank Treasurer with over 8 years of experience in financial management and strategic planning. Proven track record in optimizing asset allocation, managing liquidity, and enhancing profitability through effective risk management strategies. Adept at developing and implementing financial policies that align with organizational goals. Strong analytical skills complemented by a deep understanding of regulatory requirements and compliance. Committed to fostering relationships with stakeholders and leading teams to achieve operational excellence. Seeking to leverage expertise in a dynamic banking environment to drive financial performance and growth.

Results-driven Bank Treasurer with over 15 years of experience in financial management, risk assessment, and strategic planning within the banking sector. Proven track record of optimizing liquidity, managing investment portfolios, and ensuring regulatory compliance. Adept at developing financial strategies that enhance profitability and minimize risk. Strong leadership skills with a focus on team development and cross-functional collaboration. Committed to leveraging analytical expertise and market insights to drive financial performance and support organizational growth.

Similar Resumes

Key Job Duties & Responsibilities of Bank Treasurer

Dynamic bank treasurer responsible for overseeing financial management, ensuring liquidity, managing investment portfolios, and implementing risk mitigation strategies to optimize profitability and support organizational financial goals.

-

Cash Management: Oversee the bank's cash flow, ensuring sufficient liquidity for daily operations and obligations.

-

Investment Strategy: Develop and implement investment policies to maximize returns on the bank's assets while managing risk.

-

Risk Assessment: Identify, analyze, and mitigate financial risks that could impact the bank’s capital and liquidity.

-

Financial Reporting: Prepare accurate financial reports and forecasts to provide insights into the bank's financial position and performance.

-

Regulatory Compliance: Ensure adherence to all banking regulations, laws, and internal policies to maintain the bank’s integrity and reputation.

-

Funding Management: Manage the bank’s funding strategies, including sourcing and structuring debt and equity financing.

-

Interest Rate Management: Monitor and manage interest rate exposure to optimize the bank's profitability.

-

Treasury Operations: Supervise daily treasury operations, including cash positioning, wire transfers, and investment transactions.

-

Stakeholder Communication: Liaise with internal and external stakeholders, including auditors, regulators, and financial institutions, to foster strong relationships.

-

Team Leadership: Lead and mentor the treasury team, ensuring professional development and alignment with the bank's objectives.

-

Market Analysis: Analyze market trends and economic conditions to inform financial strategies and decision-making.

-

Policy Development: Establish and review treasury policies and procedures to enhance operational efficiency and effectiveness.

-

Strategic Planning: Contribute to the bank’s strategic planning process by providing financial insights and recommendations.

Important Sections to Add in Bank Treasurer Resume

Highlighting essential sections in a Bank Treasurer resume ensures a comprehensive presentation of skills, experience, and accomplishments. Key areas include professional summary, relevant experience, education, certifications, and technical skills to attract potential employers effectively.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure this information is current and professional.

-

Professional Summary: A brief overview of your experience and skills. Highlight your expertise in financial management, budgeting, and treasury operations to catch the employer's attention.

-

Core Competencies: List key skills relevant to the role, such as cash management, investment strategies, risk assessment, and regulatory compliance. Use bullet points for clarity.

-

Professional Experience: Detail your work history, focusing on positions related to treasury management. Include job titles, company names, dates of employment, and bullet points outlining your responsibilities and achievements.

-

Education: Provide information about your degrees, including the name of the institution, degree obtained, and graduation date. If applicable, include any relevant certifications like CPA or CFA.

-

Technical Skills: Highlight your proficiency in financial software and tools, such as ERP systems, Excel, and treasury management systems. This demonstrates your ability to leverage technology in your role.

-

Achievements: Include quantifiable accomplishments that showcase your impact, such as reducing costs, improving cash flow, or enhancing investment returns. Use specific metrics to illustrate your success.

-

Professional Affiliations: Mention any memberships in relevant organizations, such as the Association for Financial Professionals (AFP), to demonstrate your commitment to professional development.

-

References: Optionally, state that references are available upon request. This signals your readiness to provide further validation of your skills and experience.

Required Skills for Bank Treasurer Resume

When crafting your bank treasurer resume, highlight essential skills that showcase your financial expertise and leadership abilities. Focus on demonstrating your analytical thinking, strategic planning, and effective communication to stand out to potential employers.

- Financial Analysis

- Risk Management

- Cash Flow Management

- Investment Strategies

- Budgeting and Forecasting

- Regulatory Compliance

- Treasury Operations

- Financial Reporting

- Strategic Planning

- Debt Management

- Banking Regulations Knowledge

- Analytical Skills

- Communication Skills

- Leadership and Team Management

- Financial Modeling

Action Verbs to Use in Bank Treasurer Resume

Incorporating powerful action verbs in your Bank Treasurer resume enhances its impact, showcasing your skills and accomplishments effectively. These dynamic words convey your expertise, leadership, and ability to drive financial success, capturing the attention of hiring managers.

- Managed

- Analyzed

- Oversaw

- Coordinated

- Developed

- Implemented

- Streamlined

- Monitored

- Optimized

- Facilitated

- Evaluated

- Prepared

- Reconciled

- Reported

- Advised

Entry-Level Bank Treasurer Resume Sample

Looking to kickstart your banking career? Check out this sample entry-level bank treasurer resume! It showcases essential skills and experiences that can help you stand out and land that coveted first job in finance.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented and analytical finance graduate seeking an entry-level Bank Treasurer position to leverage strong quantitative skills and knowledge of financial regulations to contribute to the financial stability and growth of the organization.

Education

Bachelor of Science in Finance

University of City, City, State

Graduated: May 2023

- Relevant Coursework: Financial Management, Investment Analysis, Risk Management, Banking Operations

Skills

- Financial Analysis

- Budgeting and Forecasting

- Regulatory Compliance

- Risk Assessment

- Microsoft Excel (Advanced)

- Financial Reporting

- Attention to Detail

- Strong Analytical Skills

Experience

Finance Intern

ABC Bank, City, State

June 2022 – August 2022

- Assisted in preparing financial reports and budgets, contributing to a 15% increase in departmental efficiency.

- Conducted analysis of financial data to identify trends and potential areas for cost savings.

- Collaborated with senior staff to ensure compliance with banking regulations and internal policies.

Student Finance Association Member

University of City, City, State

September 2021 – May 2023

- Participated in workshops and seminars on financial management and investment strategies.

- Engaged in networking events with industry professionals, enhancing knowledge of banking operations and treasury functions.

Certifications

- Certified Treasury Professional (CTP) - In Progress

- Financial Risk Manager (FRM) - In Progress

References

Available upon request.

Bank Treasurer Sample Resume (Mid-Level)

Explore a comprehensive sample resume for a mid-level bank treasurer, showcasing essential skills, experience, and qualifications that highlight financial expertise, risk management, and strategic decision-making, tailored to attract potential employers in the banking sector.

Sample Resume #2

Contact Information

John Doe

123 Finance St.

Bank City, ST 12345

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Bank Treasurer with over 8 years of experience in financial management, risk assessment, and strategic planning. Proven track record of optimizing cash flow, managing investments, and ensuring regulatory compliance. Adept at fostering relationships with stakeholders and enhancing financial performance.

Skills

- Financial Analysis

- Cash Flow Management

- Investment Strategies

- Risk Management

- Regulatory Compliance

- Budgeting and Forecasting

- Team Leadership

- Financial Reporting

Professional Experience

Bank Treasurer

ABC Bank, Bank City, ST

June 2018 – Present

- Oversee daily treasury operations, managing a portfolio of $500 million in assets.

- Develop and implement cash management strategies that improved liquidity by 25%.

- Collaborate with senior management to create financial forecasts and budgets, resulting in a 15% reduction in operational costs.

- Ensure compliance with federal and state regulations, reducing audit findings by 30%.

- Lead a team of 5 finance professionals, providing mentorship and guidance to enhance team performance.

Assistant Treasurer

XYZ Financial Institution, Bank City, ST

January 2015 – May 2018

- Assisted in managing treasury operations, focusing on cash flow forecasting and investment management.

- Conducted risk assessments to identify potential financial pitfalls and recommended mitigation strategies.

- Prepared detailed financial reports for senior management, facilitating informed decision-making.

- Established relationships with institutional investors, enhancing funding options by 20%.

Education

Master of Business Administration (MBA)

University of Finance, Bank City, ST

Graduated May 2014

Bachelor of Science in Finance

State University, Bank City, ST

Graduated May 2012

Certifications

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

Professional Affiliations

- Member, Association for Financial Professionals

- Member, Treasury Management Association

References

Available upon request.

Bank Treasurer Sample Resume for Experienced Level

Looking for a standout resume format for a Senior-Level Bank Treasurer? This sample showcases essential skills, achievements, and experience, helping you present your financial expertise and leadership qualities in a compelling way to potential employers.

Sample Resume #3

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Senior Bank Treasurer with over 15 years of experience in financial management, risk assessment, and strategic planning. Proven track record in optimizing liquidity, enhancing profitability, and ensuring regulatory compliance. Adept at leading cross-functional teams and implementing innovative financial solutions to drive growth.

Core Competencies

- Liquidity Management

- Risk Assessment & Mitigation

- Financial Analysis & Reporting

- Regulatory Compliance

- Strategic Financial Planning

- Team Leadership & Development

- Investment Strategies

- Stakeholder Engagement

Professional Experience

Senior Treasurer

ABC Bank, City, State

January 2018 – Present

- Oversee the bank's treasury operations, managing a portfolio of over $2 billion in assets.

- Develop and implement liquidity management strategies, resulting in a 20% increase in net interest income.

- Collaborate with senior management to formulate financial strategies that align with organizational goals.

- Ensure compliance with all regulatory requirements, conducting regular audits and risk assessments.

- Lead a team of 10 finance professionals, fostering a culture of continuous improvement and professional development.

Treasurer

XYZ Financial Institution, City, State

June 2012 – December 2017

- Managed daily cash flow and liquidity positions, optimizing funding strategies to support business operations.

- Conducted comprehensive financial analysis to identify trends and provide actionable insights to senior leadership.

- Developed investment policies that improved portfolio performance by 15% over three years.

- Established strong relationships with regulators and external auditors, ensuring transparency and compliance.

Assistant Treasurer

123 Bank, City, State

March 2008 – May 2012

- Assisted in managing the bank’s treasury functions, including cash management and funding strategies.

- Prepared financial reports and forecasts, supporting strategic decision-making processes.

- Coordinated with various departments to streamline financial operations and improve efficiency.

Education

Master of Business Administration (MBA)

University of Finance, City, State

Graduated: May 2007

Bachelor of Science in Finance

State University, City, State

Graduated: May 2005

Certifications

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

Professional Affiliations

- Member, Association for Financial Professionals (AFP)

- Member, Global Association of Risk Professionals (GARP)

References

Available upon request.

Resume Tips That Work for Bank Treasurer Resume

Do

Do: Highlight Financial Management Skills - Emphasize your expertise in managing financial operations, including budgeting, forecasting, and financial reporting, to showcase your ability to maintain the bank's fiscal health.

Do: Showcase Risk Assessment Abilities - Detail your experience in identifying and mitigating financial risks, demonstrating your proactive approach to safeguarding the bank's assets and ensuring compliance with regulations.

Do: Demonstrate Leadership Experience - Illustrate your capability to lead and mentor a team, highlighting instances where you have successfully guided staff in achieving financial goals and improving operational efficiency.

Do: Include Technology Proficiency - Mention your familiarity with financial software and banking technologies, as well as any data analysis tools you’ve used, to convey your ability to leverage technology for improved financial management.

Do: Quantify Achievements - Provide specific metrics or outcomes from your previous roles, such as percentage reductions in costs or increases in revenue, to illustrate your impact and effectiveness as a bank treasurer.

Don't

Don't: Include irrelevant work experience. Focus on roles that showcase your financial management skills and banking expertise.

Don't: Use jargon or overly technical language. Ensure your resume is easily understandable to all potential employers, avoiding terms that may confuse them.

Don't: Neglect quantifiable achievements. Highlight specific accomplishments with numbers to demonstrate your impact and effectiveness in previous roles.

Don't: Make it too lengthy. Keep your resume concise, ideally one page, to maintain the hiring manager's attention and emphasize key points.

Don't: Forget to tailor your resume. Customize your resume for each application to align with the specific requirements and values of the institution you’re applying to.

Bank Treasurer Sample Cover Letter

A Sample Bank Treasurer Cover Letter provides a structured format and essential tips for crafting a compelling introduction, showcasing financial expertise, and highlighting relevant experience to attract potential employers in the banking sector.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Bank Treasurer position at [Bank's Name]. With over [X years] of experience in financial management and a proven track record of strategic financial planning, I am excited about the opportunity to contribute to your institution's success.

In my previous role at [Previous Company], I successfully managed a portfolio of over $[X million], ensuring optimal liquidity and risk management. My expertise in forecasting and budgeting has consistently led to improved financial performance and cost savings.

I am particularly drawn to this position because of [Bank's Name]'s commitment to innovation and community involvement. I am eager to bring my skills in financial analysis and team leadership to your organization, fostering a culture of excellence and integrity.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the goals of [Bank's Name].

Sincerely,

[Your Name]

[Your Contact Information]

FAQs about Bank Treasurer Resume

What key skills should be included on a Bank Treasurer resume to demonstrate expertise in financial management and risk assessment?

A Bank Treasurer resume should highlight skills such as financial analysis, risk management, cash flow forecasting, investment strategies, regulatory compliance, and strategic planning. Proficiency in financial modeling, data analysis, and strong communication abilities are also essential to demonstrate expertise in managing financial resources effectively.

How can a Bank Treasurer effectively highlight experience with liquidity management and investment strategies on their resume?

A Bank Treasurer can effectively highlight experience with liquidity management and investment strategies by quantifying achievements, using specific metrics to demonstrate impact, and showcasing relevant skills. Include examples of successful cash flow forecasting, risk assessment, and portfolio management, emphasizing strategic decision-making that led to improved financial stability and growth.

What educational qualifications and certifications are essential to list on a Bank Treasurer resume for a competitive edge?

A Bank Treasurer resume should highlight a bachelor's degree in finance, accounting, or business administration. Certifications such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA) enhance credibility. Additionally, advanced degrees like an MBA can provide a competitive edge in the finance industry.

How should a Bank Treasurer structure their resume to showcase achievements in optimizing bank funding and cash flow?

A Bank Treasurer's resume should highlight quantifiable achievements in funding optimization and cash flow management. Use bullet points to detail specific projects, such as improved liquidity ratios or reduced borrowing costs. Include relevant metrics, leadership roles, and any certifications to demonstrate expertise and impact in financial management.

What specific accomplishments, such as cost savings or regulatory compliance, should a Bank Treasurer emphasize on their resume to attract top banking employers?

A Bank Treasurer should emphasize accomplishments like successfully reducing operational costs by a significant percentage, achieving regulatory compliance ahead of deadlines, enhancing liquidity management, and implementing risk mitigation strategies. Highlighting these achievements demonstrates financial acumen and strategic leadership, making the candidate more attractive to top banking employers.

Bank Treasurer Resume

Objective

Results-driven finance professional with over 10 years of experience in treasury management, seeking to leverage expertise in cash flow optimization and risk management to enhance financial stability as a Bank Treasurer.

Summary/Description

Results-driven Bank Treasurer with over 10 years of experience in financial management, risk assessment, and strategic planning. Proven track record of optimizing liquidity and enhancing profitability through effective treasury operations.

Top Required Skills

Financial Analysis

Risk Management

Cash Flow Management

Regulatory Compliance

Strategic Planning

Mistakes to Avoid

Failing to highlight relevant financial management experience

Omitting key skills such as risk assessment and investment strategies

Using generic language instead of specific achievements and metrics

Important Points to Add

Expertise in financial management and investment strategies

Strong analytical skills and experience with risk assessment

Proficiency in regulatory compliance and financial reporting

View More Templates

Free Resume Templates

Free Resume Templates