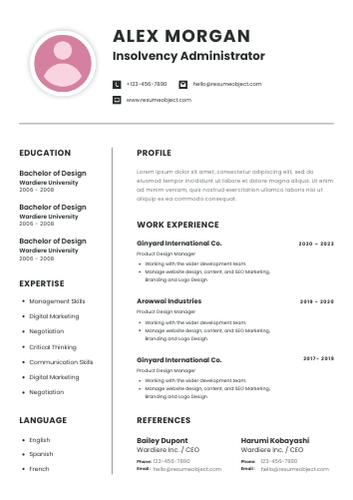

Insolvency Administrator Resume

In the competitive field of insolvency administration, having a standout resume template is crucial for showcasing your expertise. An effective sample format not only highlights your skills but also demonstrates your understanding of the insolvency process, making you an attractive candidate to potential employers.

Crafting a tailored insolvency administrator resume can significantly enhance your job prospects. By utilizing a well-structured template, you can effectively present your qualifications, experience, and achievements, ensuring you capture the attention of hiring managers in this specialized industry.

Insolvency Administrator Resume Objective Statement Examples

Insolvency Administrator Resume Objective Examples showcase candidates' skills in managing financial distress, emphasizing expertise in asset recovery, compliance, and negotiation, while highlighting a commitment to effective resolution and client support.

-

Detail-oriented Insolvency Administrator with over 5 years of experience in managing complex insolvency cases, seeking to leverage expertise in financial analysis and stakeholder communication to contribute to a dynamic team.

-

Results-driven professional with a strong background in insolvency law and asset recovery, aiming to utilize my skills in case management and negotiation to enhance the efficiency of an established insolvency practice.

-

Dedicated Insolvency Administrator seeking to apply my comprehensive knowledge of bankruptcy procedures and financial regulations to assist clients in navigating their insolvency challenges while ensuring compliance and maximizing asset recovery.

-

Proactive and analytical thinker with a proven track record in insolvency administration, looking to join a forward-thinking firm where I can utilize my strategic problem-solving abilities to optimize case outcomes and client satisfaction.

-

Experienced Insolvency Administrator eager to bring my strong organizational skills and attention to detail to a challenging role, focused on delivering exceptional service and support to clients throughout the insolvency process.

For aspiring video content creators, a standout resume is essential. Discover tips and templates to enhance your job application with our comprehensive guide on the Video Content Creator Resume.

Example Summary for Insolvency Administrator Resume

Discover a compelling resume summary tailored for an Insolvency Administrator role, highlighting essential skills, experience, and qualifications that demonstrate expertise in managing insolvency cases and supporting clients through financial challenges.

Detail-oriented and motivated recent graduate with a strong foundation in finance and business management, seeking an entry-level position as an Insolvency Administrator. Proficient in analyzing financial statements and understanding insolvency laws, with excellent organizational and communication skills. Eager to leverage analytical abilities and a passion for helping individuals and businesses navigate financial challenges to contribute effectively to a dynamic team. Committed to delivering exceptional service and support throughout the insolvency process.

Detail-oriented Insolvency Administrator with over 5 years of experience in managing complex insolvency cases and providing expert guidance throughout the insolvency process. Proven track record of effectively analyzing financial statements, negotiating with creditors, and developing strategic plans to maximize asset recovery. Strong communication and organizational skills, adept at working collaboratively with stakeholders to ensure compliance and facilitate smooth resolutions. Committed to delivering exceptional service while upholding ethical standards in all aspects of insolvency administration.

Results-driven Insolvency Administrator with over 10 years of experience in managing complex insolvency cases and providing expert guidance on financial restructuring. Proficient in assessing financial statements, developing recovery strategies, and negotiating settlements with creditors. Demonstrated ability to navigate legal frameworks and ensure compliance with regulatory requirements, while maintaining strong relationships with stakeholders. Adept at leading cross-functional teams and delivering exceptional results under pressure. Committed to maximizing asset recovery and minimizing losses for clients through strategic planning and meticulous attention to detail.

Similar Resumes

Key Job Duties & Responsibilities of Insolvency Administrator

Insolvency Administrators manage financial distress cases, ensuring compliance with legal regulations, facilitating asset distribution, and providing expert guidance to stakeholders, ultimately striving for fair resolutions and optimal outcomes.

-

Managing Insolvency Cases: Oversee and administer various insolvency cases, including bankruptcies and company liquidations, ensuring compliance with legal requirements.

-

Conducting Investigations: Investigate the financial affairs of insolvent individuals or companies to determine the causes of insolvency and identify any potential misconduct.

-

Preparing Reports: Draft detailed reports for creditors and regulatory bodies outlining the financial status of the insolvent party, including asset valuations and recovery options.

-

Asset Management: Identify, secure, and manage the assets of the insolvent entity, ensuring maximum recovery for creditors.

-

Liaising with Creditors: Communicate with creditors to provide updates on the insolvency process, answer queries, and facilitate meetings where necessary.

-

Negotiating Settlements: Negotiate with creditors and stakeholders to reach settlements that are in the best interest of all parties involved.

-

Compliance with Legislation: Ensure that all actions taken during the insolvency process comply with relevant legislation and regulatory guidelines.

-

Handling Claims: Review and process claims submitted by creditors, determining their validity and prioritizing them according to legal frameworks.

-

Coordinating with Legal Advisors: Work closely with legal professionals to address any legal issues that arise during the insolvency process.

-

Providing Support: Offer support and guidance to debtors throughout the insolvency process, helping them understand their rights and obligations.

-

Maintaining Records: Keep accurate and detailed records of all transactions and communications related to the insolvency case.

-

Continuous Professional Development: Stay updated on changes in insolvency law and best practices through ongoing training and professional development.

Important Sections to Add in Insolvency Administrator Resume

An effective Insolvency Administrator resume should include key sections such as professional summary, relevant experience, skills, certifications, and education, highlighting expertise in managing insolvency cases and demonstrating a strong understanding of financial regulations and processes.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure this information is easy to find and up to date.

-

Professional Summary: A brief overview of your experience and skills as an insolvency administrator. Highlight your key achievements and what sets you apart from other candidates.

-

Core Competencies: List relevant skills such as financial analysis, risk assessment, negotiation, and knowledge of insolvency laws. Use bullet points for clarity.

-

Work Experience: Detail your previous roles in insolvency administration. Include job titles, company names, locations, and dates of employment. Focus on specific accomplishments and responsibilities that demonstrate your expertise.

-

Education: Mention your degrees, certifications, and relevant coursework. Include the name of the institution, degree obtained, and graduation date. Highlight any specialized training in insolvency or financial management.

-

Certifications and Licenses: List any relevant certifications, such as Certified Insolvency and Restructuring Advisor (CIRA) or similar credentials. This adds credibility to your qualifications.

-

Professional Affiliations: Include memberships in professional organizations related to insolvency and restructuring. This shows your commitment to the field and networking capabilities.

-

Technical Skills: Mention any software or tools you are proficient in, such as financial modeling software, bankruptcy management systems, or data analysis tools.

-

Achievements and Awards: Highlight any recognitions or awards received for your work in insolvency or related fields. This can include successful case resolutions or contributions to industry publications.

-

References: Include a statement indicating that references are available upon request, or provide references if specifically requested in the job application.

Required Skills for Insolvency Administrator Resume

When crafting your insolvency administrator resume, highlight essential skills that showcase your expertise in managing financial distress. Focus on your analytical abilities, communication strengths, and attention to detail to stand out to potential employers.

- Financial Analysis

- Risk Assessment

- Legal Knowledge

- Negotiation Skills

- Communication Skills

- Problem-Solving

- Attention to Detail

- Time Management

- Project Management

- Client Relationship Management

- Report Writing

- Data Analysis

- Regulatory Compliance

- Team Collaboration

- Strategic Planning

Action Verbs to Use in Insolvency Administrator Resume

Incorporating powerful action verbs in your Insolvency Administrator resume enhances its impact, showcasing your skills and achievements effectively. These verbs convey decisiveness and competence, making your application stand out to potential employers in a competitive field.

- Analyzed

- Assessed

- Managed

- Resolved

- Negotiated

- Coordinated

- Facilitated

- Implemented

- Streamlined

- Advised

- Oversaw

- Evaluated

- Developed

- Organized

- Executed

Entry-Level Insolvency Administrator Resume Sample

Looking to kickstart your career in insolvency? Check out this sample entry-level insolvency administrator resume that highlights essential skills and experiences, helping you stand out to potential employers in this competitive field.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, Zip

Email: [email protected]

Phone: (123) 456-7890

Objective

Detail-oriented and motivated recent graduate seeking an entry-level Insolvency Administrator position to leverage analytical skills and knowledge of financial regulations to assist clients in navigating insolvency processes.

Education

Bachelor of Commerce in Finance

University of City, City, State

Graduated: May 2023

Relevant Coursework

- Financial Accounting

- Business Law

- Corporate Finance

- Bankruptcy Law

Skills

- Strong analytical and problem-solving abilities

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Knowledge of insolvency regulations and procedures

- Excellent written and verbal communication skills

- Attention to detail and organizational skills

Internship Experience

Finance Intern

ABC Financial Services, City, State

June 2022 - August 2022

- Assisted in the preparation of financial documents for insolvency proceedings.

- Conducted research on insolvency laws and regulations to support senior administrators.

- Collaborated with team members to analyze client financial situations and develop strategies for debt resolution.

Certifications

- Certified Insolvency Administrator (CIA) - Expected completion May 2024

- Financial Modeling and Valuation Analyst (FMVA) - Completed August 2023

Professional Affiliations

- Member, National Association of Bankruptcy Trustees (NABT)

- Member, Student Finance Association

References

Available upon request.

Insolvency Administrator Sample Resume (Mid-Level)

This sample mid-level insolvency administrator resume showcases essential skills, experience, and qualifications necessary for effectively managing insolvency processes, ensuring compliance, and providing strategic financial solutions to clients facing financial distress.

Sample Resume #2

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Detail-oriented and experienced Insolvency Administrator with over 5 years of expertise in managing insolvency cases, preparing financial reports, and ensuring compliance with legal requirements. Proven track record in negotiating settlements and maximizing asset recovery for creditors. Strong analytical skills combined with a commitment to ethical practices and client satisfaction.

Core Competencies

- Insolvency and Bankruptcy Law

- Financial Analysis and Reporting

- Asset Recovery Strategies

- Client Relationship Management

- Regulatory Compliance

- Negotiation and Settlement

- Team Leadership

- Case Management Software

Professional Experience

Insolvency Administrator

XYZ Insolvency Services, City, State

January 2019 – Present

- Managed a portfolio of over 100 insolvency cases, ensuring timely and accurate reporting to stakeholders.

- Conducted comprehensive financial analyses to assess the viability of debt restructuring options.

- Collaborated with legal teams to prepare documentation for court proceedings and creditor meetings.

- Negotiated settlements with creditors, achieving a 30% increase in asset recovery rates.

- Developed and implemented best practices for case management, improving efficiency by 20%.

Junior Insolvency Administrator

ABC Financial Solutions, City, State

June 2016 – December 2018

- Assisted senior administrators in managing insolvency cases, including preparing financial statements and reports.

- Conducted due diligence on debtor assets and liabilities to support case evaluations.

- Maintained accurate records in case management software, ensuring compliance with regulatory standards.

- Supported client communications, addressing inquiries and providing updates on case progress.

Education

Bachelor of Commerce in Accounting

University of State, City, State

Graduated: May 2016

Certifications

- Certified Insolvency and Restructuring Advisor (CIRA)

- Member, Association of Insolvency Practitioners

Professional Affiliations

- Association of Insolvency Practitioners

- International Association of Restructuring, Insolvency & Bankruptcy Professionals

References

Available upon request.

Insolvency Administrator Sample Resume for Experienced Level

Looking to showcase your expertise as a Senior-Level Insolvency Administrator? Check out this sample resume format designed to highlight your skills, achievements, and experience, making you stand out to potential employers in the insolvency field.

Sample Resume #3

Contact Information

John Doe

1234 Elm Street

City, State, ZIP

Email: [email protected]

Phone: (123) 456-7890

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven and detail-oriented Senior Insolvency Administrator with over 10 years of experience in managing insolvency cases, guiding clients through complex financial situations, and ensuring compliance with legal requirements. Proven track record of maximizing asset recovery and minimizing losses while providing exceptional client service. Strong analytical skills and a deep understanding of insolvency laws and regulations.

Core Competencies

- Insolvency Law & Regulations

- Financial Analysis & Reporting

- Asset Valuation & Recovery

- Client Relationship Management

- Risk Assessment & Mitigation

- Team Leadership & Training

- Negotiation & Mediation Skills

- Compliance & Regulatory Adherence

Professional Experience

Senior Insolvency Administrator

ABC Insolvency Services, City, State

January 2018 – Present

- Lead a team of insolvency professionals in managing a diverse portfolio of insolvency cases, ensuring timely and effective resolution.

- Conduct thorough financial assessments and valuations of assets to maximize recovery for creditors.

- Develop and implement strategic plans for each case, negotiating with stakeholders to achieve optimal outcomes.

- Maintain up-to-date knowledge of insolvency laws and regulations, ensuring compliance and minimizing legal risks.

- Provide expert advice to clients on their rights and obligations under insolvency proceedings.

Insolvency Administrator

XYZ Financial Solutions, City, State

June 2013 – December 2017

- Managed a caseload of over 50 insolvency cases, providing comprehensive support to clients throughout the process.

- Assisted in the preparation of financial statements, reports, and documentation required for court proceedings.

- Collaborated with legal teams to develop case strategies and represent clients in negotiations.

- Conducted risk assessments and implemented measures to protect client interests and assets.

Junior Insolvency Administrator

DEF Consulting Group, City, State

August 2010 – May 2013

- Supported senior administrators in the management of insolvency cases, conducting research and analysis of financial documents.

- Assisted in the preparation of reports and presentations for creditors and stakeholders.

- Developed a strong understanding of insolvency processes and regulations, contributing to successful case outcomes.

Education

Bachelor of Business Administration (BBA)

University of City, State

Graduated: May 2010

Certifications

- Certified Insolvency Administrator (CIA)

- Member of the Association of Insolvency Practitioners

Professional Affiliations

- Association of Insolvency Practitioners (AIP)

- National Association of Bankruptcy Trustees (NABT)

References

Available upon request.

Resume Tips That Work for Insolvency Administrator Resume

Do

Do: Highlight your expertise in insolvency law by detailing your knowledge of relevant regulations and procedures, showcasing your ability to navigate complex legal frameworks effectively.

Do: Showcase your experience in managing insolvency cases by including specific examples of cases you've handled, emphasizing your role in guiding clients through the insolvency process.

Do: Emphasize your communication skills by illustrating how you effectively interact with clients, creditors, and legal professionals, ensuring all parties are informed and engaged throughout the process.

Do: Demonstrate your analytical abilities by providing examples of how you've assessed financial situations, identified key issues, and developed strategic plans to resolve insolvency challenges.

Do: Include your proficiency in financial reporting and documentation by highlighting your experience in preparing accurate reports, maintaining records, and ensuring compliance with all necessary regulations.

Don't

Don't: Overstate your qualifications. Be honest about your experience and skills to maintain credibility with potential employers.

Don't: Use jargon excessively. Avoid complicated terminology that may confuse readers; instead, focus on clear and concise language that highlights your expertise.

Don't: Neglect to quantify achievements. Provide specific metrics and outcomes from previous roles to demonstrate your impact and effectiveness as an Insolvency Administrator.

Don't: Ignore tailoring your resume. Customize your resume for each application to align with the specific requirements and preferences of the job description.

Don't: Forget to proofread. Ensure your resume is free from spelling and grammatical errors, as these can undermine your professionalism and attention to detail.

Insolvency Administrator Sample Cover Letter

A sample insolvency administrator cover letter provides a professional template highlighting key skills, experience, and qualifications, helping applicants craft a compelling introduction that demonstrates their suitability for insolvency management roles.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insolvency Administrator position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in insolvency management and a proven track record of successfully navigating complex financial situations, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I managed a diverse portfolio of insolvency cases, ensuring compliance with legal regulations while providing exceptional support to clients. My expertise in financial analysis and attention to detail allowed me to develop tailored solutions that maximized recovery rates and minimized losses. I pride myself on my ability to communicate effectively with stakeholders, guiding them through challenging circumstances with empathy and professionalism.

I am particularly drawn to [Company Name] because of its commitment to integrity and client-focused service. I am eager to bring my skills in case management and negotiation to your organization, helping to deliver positive outcomes for clients facing financial difficulties.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and passion for insolvency administration align with the goals of [Company Name].

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

FAQs about Insolvency Administrator Resume

What should be included in the resume summary for an Insolvency Administrator?

A resume summary for an Insolvency Administrator should include relevant experience in managing insolvency cases, expertise in financial analysis, strong communication skills, and a track record of successful negotiations. Highlight your ability to work under pressure, attention to detail, and knowledge of legal regulations in insolvency.

How can entry-level candidates effectively showcase their potential on an Insolvency Administrator resume?

Entry-level candidates can effectively showcase their potential on an Insolvency Administrator resume by highlighting relevant coursework, internships, and transferable skills such as analytical thinking, attention to detail, and communication. Including any volunteer experience in financial settings and demonstrating a willingness to learn can also strengthen their application.

What are the key differences between mid-level and senior-level Insolvency Administrator resumes?

Mid-level Insolvency Administrator resumes typically emphasize foundational skills, relevant experience, and certifications, focusing on operational tasks. In contrast, senior-level resumes highlight leadership roles, strategic decision-making, extensive industry knowledge, and successful project outcomes, showcasing a deeper understanding of complex insolvency issues and client management.

Are there specific certifications that should be highlighted on an Insolvency Administrator resume?

Yes, highlighting certifications such as Certified Insolvency and Restructuring Advisor (CIRA), Chartered Accountant (CA), or Certified Public Accountant (CPA) can enhance your resume. These credentials demonstrate expertise in insolvency processes, financial analysis, and regulatory compliance, making you a more attractive candidate to potential employers.

What are common mistakes to avoid when formatting an Insolvency Administrator resume?

Common mistakes to avoid when formatting an Insolvency Administrator resume include using inconsistent fonts and sizes, overcrowding with text, neglecting white space, and failing to tailor content to the job description. Ensure clear headings, bullet points for readability, and a professional layout to enhance overall presentation and impact.

Insolvency Administrator Resume

Objective

Detail-oriented Insolvency Administrator with expertise in financial analysis and debt restructuring, seeking to leverage strong organizational skills and regulatory knowledge to support clients in navigating insolvency processes effectively.

Summary/Description

Detail-oriented Insolvency Administrator with extensive experience in managing insolvency cases, analyzing financial statements, and ensuring compliance. Proven track record in maximizing asset recovery and providing exceptional client support throughout the process.

Top Required Skills

Financial Analysis

Negotiation Skills

Legal Knowledge

Communication Skills

Problem-Solving Skills

Mistakes to Avoid

Lack of specific insolvency-related experience or qualifications.

Failing to highlight key skills such as financial analysis and negotiation.

Using generic language instead of tailored achievements and metrics.

Important Points to Add

Strong knowledge of insolvency laws and regulations

Proven experience in managing insolvency cases and financial assessments

Excellent communication and negotiation skills

View More Templates

Free Resume Templates

Free Resume Templates