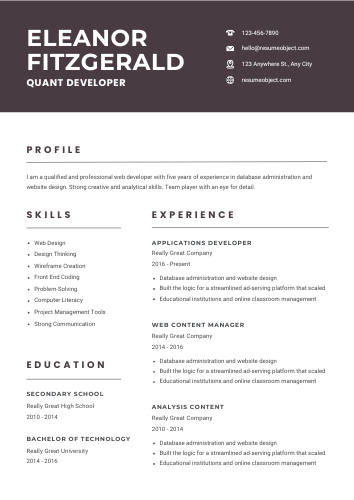

Quant Developer Resume

In the competitive field of quantitative finance, a strong Quant Developer resume is essential for standing out to potential employers. Crafting a resume that highlights your technical skills, programming expertise, and analytical abilities can significantly enhance your chances of landing an interview.

Utilizing a well-structured resume template can streamline the process of showcasing your qualifications. By incorporating industry-specific keywords and a clear format, you can effectively communicate your value as a Quant Developer to hiring managers.

Quant Developer Resume Objective Statement Examples

Explore effective Quant Developer resume objective examples that highlight your analytical skills, programming expertise, and financial acumen, helping you stand out in competitive job markets and attract potential employers.

-

To leverage my expertise in quantitative analysis and programming to develop robust trading algorithms that enhance portfolio performance.

-

Seeking a Quant Developer position where I can apply my strong mathematical background and proficiency in Python and C++ to create innovative financial models.

-

To obtain a challenging role as a Quant Developer, utilizing my skills in statistical analysis and machine learning to drive data-driven investment strategies.

-

Aspiring to contribute to a dynamic team as a Quant Developer, focusing on the development of high-frequency trading systems that maximize returns and minimize risk.

-

To secure a Quant Developer position that allows me to integrate my programming skills and financial knowledge to optimize trading strategies and improve decision-making processes.

Explore our comprehensive guide on creating an effective Airport Driver Resume that highlights your skills and experience, ensuring you stand out in this competitive job market and land your dream job.

Example Summary for Quant Developer Resume

This section provides a concise example of a resume summary tailored for a Quant Developer role, highlighting essential skills, experience, and achievements to attract potential employers effectively.

Detail-oriented and analytical recent graduate with a strong foundation in quantitative analysis, programming, and financial modeling. Proficient in Python, R, and SQL, with hands-on experience in data analysis and algorithm development. Demonstrated ability to solve complex problems and optimize trading strategies through academic projects and internships. Eager to leverage technical skills and passion for finance to contribute to a dynamic quantitative team.

Results-driven Quantitative Developer with over 5 years of experience in developing and implementing quantitative models and algorithms for financial markets. Proficient in Python, C++, and R, with a strong background in statistical analysis and machine learning techniques. Demonstrated ability to optimize trading strategies and enhance risk management processes, contributing to increased profitability and reduced operational risk. Excellent problem-solving skills and a collaborative mindset, seeking to leverage expertise in a dynamic trading environment to drive innovative solutions and support strategic decision-making.

Results-driven Quant Developer with over 10 years of experience in quantitative analysis, algorithmic trading, and financial modeling. Expertise in developing and implementing complex quantitative models and strategies that enhance trading performance and risk management. Proficient in programming languages such as Python, C++, and R, with a strong foundation in statistical analysis and machine learning techniques. Proven track record of collaborating with cross-functional teams to deliver innovative solutions in fast-paced trading environments. Adept at translating complex data into actionable insights, driving informed decision-making and optimizing trading strategies. Seeking to leverage extensive quantitative skills and financial acumen to contribute to a dynamic trading team.

Similar Resumes

Key Job Duties & Responsibilities of Quant Developer

Dynamic Quant Developer skilled in designing and implementing quantitative models, optimizing trading strategies, and enhancing data analysis processes to drive informed decision-making and maximize financial performance.

-

Develop Quantitative Models: Create and implement mathematical models to analyze financial data and assess risks.

-

Algorithm Development: Design and optimize algorithms for trading strategies, focusing on performance and accuracy.

-

Data Analysis: Analyze large datasets to identify trends, patterns, and anomalies that can inform trading decisions.

-

Backtesting: Conduct backtesting of trading strategies to evaluate their effectiveness and make necessary adjustments.

-

Collaboration: Work closely with traders, risk managers, and other stakeholders to understand their needs and integrate quantitative solutions.

-

Programming: Write and maintain code in programming languages such as Python, C++, or R for model implementation and data analysis.

-

Market Research: Stay updated on market trends, financial instruments, and quantitative techniques to enhance model performance.

-

Performance Monitoring: Continuously monitor the performance of quantitative models and algorithms, making adjustments as needed.

-

Documentation: Prepare comprehensive documentation of models, algorithms, and methodologies for future reference and compliance purposes.

-

Risk Management: Identify and assess risks associated with quantitative strategies and develop mitigation plans.

-

Tool Development: Create and improve tools and frameworks that facilitate quantitative analysis and trading.

-

Training & Mentorship: Provide guidance and support to junior team members in quantitative methods and programming practices.

-

Regulatory Compliance: Ensure that all quantitative activities comply with relevant regulations and industry standards.

-

Presentation of Findings: Communicate complex quantitative concepts and findings to non-technical stakeholders in an understandable manner.

Important Sections to Add in Quant Developer Resume

Highlighting key sections in a Quant Developer resume, such as technical skills, relevant experience, education, and projects, is crucial for showcasing expertise and attracting potential employers in the competitive finance and technology sectors.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure your email is professional.

-

Summary Statement: A brief overview of your qualifications and career goals. Highlight your experience in quantitative analysis, programming skills, and any relevant financial knowledge.

-

Technical Skills: List programming languages (e.g., Python, C++, R), statistical tools, and software (e.g., MATLAB, SQL) that are pertinent to quantitative finance.

-

Education: Detail your academic background, including degrees earned, institutions attended, and relevant coursework. Emphasize any advanced degrees in quantitative fields like mathematics, statistics, or finance.

-

Work Experience: Provide a chronological list of your relevant positions. Focus on quant roles, internships, or projects, detailing your responsibilities and achievements. Use quantifiable metrics to demonstrate your impact.

-

Projects: Highlight specific quantitative projects you’ve worked on. Include the problem addressed, methodologies used, and results achieved. This showcases your practical experience and problem-solving abilities.

-

Certifications: Mention any relevant certifications, such as CFA, FRM, or courses in data science and machine learning, which can enhance your credibility.

-

Publications and Research: Include any papers or research you’ve published in academic journals or conferences, showcasing your expertise and contributions to the field.

-

Professional Affiliations: List memberships in professional organizations related to finance and quantitative analysis, indicating your commitment to staying current in the industry.

-

Soft Skills: Briefly mention skills such as teamwork, communication, and problem-solving, which are vital in collaborative work environments.

Required Skills for Quant Developer Resume

When crafting your Quant Developer resume, highlight essential skills that showcase your analytical prowess, programming expertise, and financial knowledge. Tailor your experience to demonstrate how you can drive data-driven decisions in a fast-paced environment.

- Proficiency in programming languages (Python, C++, Java)

- Strong knowledge of algorithms and data structures

- Experience with quantitative finance and financial modeling

- Familiarity with statistical analysis and machine learning

- Understanding of financial instruments (equities, derivatives, fixed income)

- Expertise in database management and SQL

- Ability to work with version control systems (Git)

- Experience in developing trading strategies

- Knowledge of risk management techniques

- Proficiency in data visualization tools (Tableau, Matplotlib)

- Strong mathematical and statistical skills

- Familiarity with cloud computing and big data technologies

- Experience with backtesting frameworks

- Understanding of software development life cycle (SDLC)

- Excellent problem-solving and analytical skills

Action Verbs to Use in Quant Developer Resume

Incorporating powerful action verbs in your Quant Developer resume enhances clarity and impact, effectively showcasing your skills and accomplishments. These verbs convey your expertise and drive, helping you stand out to potential employers in a competitive job market.

- Analyzed

- Developed

- Implemented

- Optimized

- Designed

- Automated

- Evaluated

- Executed

- Quantified

- Simulated

- Programmed

- Collaborated

- Forecasted

- Enhanced

- Researched

Entry-Level Quant Developer Resume Sample

Looking to kickstart your career as a Quant Developer? Check out this sample entry-level resume that highlights essential skills, relevant coursework, and practical experience to help you stand out in the competitive finance industry.

Sample Resume #1

Contact Information

John Doe

123 Main St, City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented and analytical recent graduate with a strong foundation in quantitative finance and programming. Seeking an entry-level Quant Developer position to leverage my skills in data analysis, algorithm development, and financial modeling to contribute to a dynamic team.

Education

Bachelor of Science in Financial Engineering

University of XYZ, City, State

Graduated: May 2023

- Relevant Coursework: Stochastic Calculus, Financial Modeling, Statistical Analysis, Machine Learning

- Projects: Developed a predictive model for stock prices using Python and machine learning techniques.

Technical Skills

- Programming Languages: Python, C++, R

- Tools & Technologies: SQL, Git, MATLAB

- Financial Knowledge: Derivatives pricing, Risk management, Portfolio optimization

- Data Analysis: Pandas, NumPy, SciPy

Experience

Quantitative Intern

ABC Financial Services, City, State

June 2022 – August 2022

- Assisted in developing quantitative models for risk assessment and pricing of financial instruments.

- Conducted data analysis using Python and SQL to identify trends and optimize trading strategies.

- Collaborated with senior quants to enhance existing algorithms and improve execution efficiency.

Research Assistant

University of XYZ, City, State

September 2021 – May 2022

- Conducted research on algorithmic trading strategies and their effectiveness in various market conditions.

- Analyzed large datasets to extract actionable insights and presented findings to faculty.

- Contributed to academic papers and presentations on quantitative finance topics.

Certifications

- CFA Level I Candidate

- Data Science Professional Certificate (Coursera)

Projects

- Stock Price Prediction Model: Developed a machine learning model to predict stock prices based on historical data, achieving an accuracy of 85%.

- Algorithmic Trading Bot: Created a trading bot using Python that implements a simple moving average strategy, backtested over the last five years.

Professional Affiliations

- Member, Quantitative Finance Society, University of XYZ

- Participant, Hackathon for Finance, 2022

References

Available upon request.

Quant Developer Sample Resume (Mid-Level)

This sample mid-level quant developer resume showcases essential skills, relevant experience, and technical expertise, designed to attract hiring managers in the finance and technology sectors. It emphasizes quantitative analysis, programming proficiency, and problem-solving abilities.

Sample Resume #2

Contact Information

John Doe

123 Finance St.

New York, NY 10001

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Summary

Detail-oriented Quant Developer with over 5 years of experience in developing quantitative models and algorithms for trading strategies. Proficient in programming languages including Python, C++, and R, with a strong background in statistical analysis and financial mathematics. Adept at collaborating with traders and researchers to optimize performance and enhance profitability.

Education

Master of Financial Engineering

Columbia University, New York, NY

Graduated: May 2018

Bachelor of Science in Mathematics

University of California, Berkeley, CA

Graduated: May 2015

Technical Skills

- Programming Languages: Python, C++, R, Java

- Tools & Technologies: SQL, Git, Jupyter Notebooks, MATLAB

- Financial Knowledge: Derivatives, Risk Management, Portfolio Optimization

- Data Analysis: Pandas, NumPy, SciPy, Machine Learning

Professional Experience

Quantitative Developer

XYZ Capital Management, New York, NY

June 2018 - Present

- Developed and implemented quantitative trading strategies that increased portfolio returns by 15% year-over-year.

- Collaborated with traders to create risk management tools and optimize existing trading algorithms.

- Conducted statistical analysis and backtesting of trading models using Python and R.

- Automated data collection processes, reducing manual work by 30% and improving accuracy.

Junior Quant Developer

ABC Hedge Fund, San Francisco, CA

June 2015 - May 2018

- Assisted in the development of high-frequency trading algorithms, contributing to a 10% increase in trade execution speed.

- Performed data analysis and visualization to identify market trends and inform trading decisions.

- Wrote and maintained documentation for quantitative models and systems.

- Engaged in regular code reviews and collaborated with the development team to enhance software quality.

Projects

- Algorithmic Trading Bot: Designed a Python-based trading bot that utilizes machine learning algorithms to predict stock price movements, achieving a 20% return on investment during testing.

- Risk Assessment Tool: Developed a risk assessment tool in R that evaluates portfolio risk and generates reports for stakeholders, enhancing decision-making processes.

Certifications

- Chartered Financial Analyst (CFA) Level I

- Financial Risk Manager (FRM)

Professional Affiliations

- Member, International Association for Quantitative Finance

- Member, CFA Institute

References

Available upon request.

Quant Developer Sample Resume for Experienced Level

Looking to land a senior-level quant developer role? Check out this resume sample format designed to showcase your skills, experience, and achievements effectively, helping you stand out in a competitive job market.

Sample Resume #3

Contact Information

John Doe

123 Finance St.

New York, NY 10001

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Quant Developer with over 8 years of experience in financial modeling, algorithm development, and quantitative analysis. Proven track record of delivering high-performance trading systems and optimizing existing models. Adept at collaborating with cross-functional teams to drive innovative solutions that enhance trading strategies and risk management.

Technical Skills

- Programming Languages: Python, C++, Java, R, SQL

- Tools & Technologies: MATLAB, TensorFlow, KDB+/q, Git, JIRA

- Financial Knowledge: Derivatives, Fixed Income, Equities, Risk Management

- Quantitative Techniques: Statistical Analysis, Machine Learning, Time Series Analysis

Professional Experience

Senior Quant Developer

XYZ Financial Services, New York, NY

June 2018 - Present

- Developed and implemented high-frequency trading algorithms, improving execution speed by 30%.

- Collaborated with quantitative analysts to create models for pricing derivatives, resulting in a 15% increase in accuracy.

- Optimized existing trading systems, reducing latency by 20% through code refactoring and system enhancements.

- Conducted backtesting and validation of trading strategies, leading to a successful deployment in live trading environments.

Quantitative Developer

ABC Investments, New York, NY

January 2015 - May 2018

- Designed and maintained quantitative models for equity and fixed-income portfolios, enhancing risk-adjusted returns.

- Automated data collection and analysis processes, reducing manual effort by 40%.

- Worked closely with traders to identify and implement algorithmic trading strategies that align with market trends.

- Presented findings and insights to stakeholders, facilitating informed decision-making on investment strategies.

Junior Quant Developer

DEF Capital, New York, NY

June 2013 - December 2014

- Assisted in the development of pricing models for various financial instruments, contributing to risk assessment efforts.

- Supported senior developers in the maintenance and optimization of existing trading systems.

- Participated in data analysis projects, providing insights that informed trading strategies and risk management practices.

Education

Master of Science in Financial Engineering

Columbia University, New York, NY

Graduated: May 2013

Bachelor of Science in Computer Science

University of California, Berkeley, CA

Graduated: May 2011

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate

- Financial Risk Manager (FRM)

Professional Affiliations

- Member, International Association for Quantitative Finance

- Member, CFA Institute

References

Available upon request.

Resume Tips That Work for Quant Developer Resume

Do

Do: Highlight Relevant Technical Skills - Emphasize your proficiency in programming languages such as Python, C++, or Java, and tools like SQL and R that are essential for quantitative analysis.

Do: Showcase Quantitative Analysis Experience - Include specific projects or roles where you applied quantitative methods to solve complex problems, demonstrating your ability to derive insights from data.

Do: Demonstrate Financial Knowledge - Mention your understanding of financial instruments, market trends, and risk management techniques, which are crucial for a quant developer role.

Do: Include Academic Achievements - List relevant degrees, certifications, or coursework in mathematics, statistics, finance, or computer science that highlight your educational background.

Do: Quantify Your Achievements - Use metrics to illustrate your contributions, such as improved model performance by a certain percentage or reduced processing time, to make your impact clear to potential employers.

Don't

Don't: Include irrelevant work experience - Focus on roles that highlight your quantitative skills and financial knowledge, avoiding unrelated positions that clutter your resume.

Don't: Use jargon without explanation - While industry terms can demonstrate expertise, ensure that they are understandable to a broader audience, especially if the resume is reviewed by HR.

Don't: Neglect to showcase technical skills - Clearly list programming languages, tools, and technologies you are proficient in, as these are crucial for a Quant Developer role.

Don't: Make it too lengthy - Keep your resume concise, ideally one page, to maintain the reader's attention and ensure that the most important information stands out.

Don't: Forget to quantify achievements - Use specific metrics to demonstrate your impact, such as improved model accuracy or reduced processing time, to make your contributions tangible.

Quant Developer Sample Cover Letter

This sample quant developer cover letter showcases essential skills and experiences, highlighting technical expertise, problem-solving abilities, and a strong passion for quantitative finance, effectively capturing the attention of potential employers in the competitive job market.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Quant Developer position at [Company Name], as advertised on [where you found the job listing]. With a strong background in financial modeling and a passion for leveraging technology to solve complex problems, I am excited about the opportunity to contribute to your team.

During my previous role at [Previous Company Name], I successfully developed and implemented quantitative models that improved trading strategies and enhanced risk management processes. My proficiency in programming languages such as Python, C++, and R, combined with my experience in data analysis, has equipped me with the skills necessary to excel in this position.

I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in the financial sector. I believe my analytical skills and problem-solving abilities align well with your team's goals. I am eager to bring my expertise in quantitative analysis and algorithm development to help drive your projects forward.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the success of [Company Name].

Sincerely,

[Your Name]

[Your Contact Information]

[LinkedIn Profile or Website]

FAQs about Quant Developer Resume

What key skills should be highlighted on a Quant Developer resume?

Highlight strong programming skills in languages like Python, C++, or Java, along with proficiency in data analysis and statistical modeling. Emphasize knowledge of financial markets, algorithms, and quantitative methods. Additionally, showcase problem-solving abilities, attention to detail, and experience with relevant tools and technologies, such as machine learning and databases.

How important is programming proficiency for a Quant Developer position?

Programming proficiency is crucial for a Quant Developer position, as it enables the implementation of complex algorithms and models. Strong skills in languages like Python, C++, or R are essential for data analysis, quantitative modeling, and efficient coding, ultimately driving successful financial strategies and solutions.

What educational background is typically required for a Quant Developer?

Quant Developers typically hold advanced degrees in quantitative fields such as mathematics, statistics, computer science, or engineering. A strong foundation in programming languages like Python, C++, or Java, along with experience in financial modeling and data analysis, is also highly beneficial for this role.

How can I showcase my quantitative analysis experience on my resume?

Highlight your quantitative analysis experience by detailing specific projects, tools, and methodologies used. Include metrics to demonstrate impact, such as improved efficiency or increased profitability. Use clear, concise language and tailor your descriptions to align with the job requirements, emphasizing relevant skills and achievements.

What types of projects or work experience should I include to impress potential employers?

Include projects that showcase your quantitative analysis, programming skills, and financial modeling. Highlight internships, research, or personal projects involving data analysis, algorithm development, or statistical modeling. Emphasize any experience with relevant tools and technologies, such as Python, R, or SQL, to demonstrate your technical proficiency and problem-solving abilities.

Quant Developer Resume

Objective

Results-driven Quant Developer with expertise in financial modeling and algorithm development, seeking to leverage strong analytical skills and programming proficiency to enhance trading strategies and optimize quantitative research at a leading firm.

Summary/Description

Results-driven Quant Developer with expertise in algorithm development, statistical analysis, and financial modeling. Proficient in Python and C++, delivering innovative solutions to optimize trading strategies and enhance portfolio performance.

Top Required Skills

Programming (Python, C++, Java)

Mathematical Modeling

Data Analysis and Statistical Techniques

Financial Knowledge and Market Understanding

Algorithm Development

Mistakes to Avoid

Failing to highlight relevant programming skills (e.g., Python, C++, R).

Omitting quantitative and statistical analysis experience.

Lack of specific achievements or quantifiable results in previous roles.

Important Points to Add

Strong programming skills in languages such as Python, C++, or Java

Proficiency in quantitative analysis and financial modeling

Experience with statistical tools and libraries (e.g., R, MATLAB, NumPy)

View More Templates

Free Resume Templates

Free Resume Templates