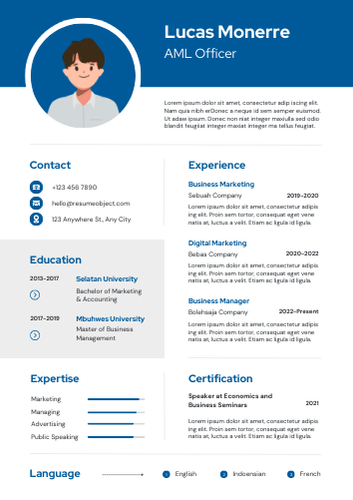

AML Officer Resume

In today's competitive job market, having a standout AML Officer resume is crucial for landing your dream position. An effective resume template not only highlights your skills but also showcases your expertise in anti-money laundering compliance, making you an attractive candidate to potential employers.

Using a well-structured sample format can streamline your application process, ensuring you present your qualifications clearly and professionally. By incorporating industry-specific keywords, you can enhance your visibility and increase your chances of securing an interview in this vital field.

AML Officer Resume Objective Statement Examples

Explore effective AML Officer resume objective examples that highlight your expertise in anti-money laundering, compliance, and risk management, showcasing your commitment to safeguarding financial institutions and ensuring regulatory adherence.

-

Detail-oriented AML Officer with over 5 years of experience in financial crime prevention, seeking to leverage expertise in regulatory compliance and risk assessment to enhance the integrity of the financial institution.

-

Results-driven AML Officer aiming to utilize advanced analytical skills and knowledge of AML regulations to identify and mitigate potential risks, ensuring compliance and protecting the organization from financial crime.

-

Dedicated AML Officer with a proven track record in conducting thorough investigations and implementing effective compliance programs, looking to contribute to a dynamic team focused on safeguarding against money laundering activities.

-

Proactive AML Officer seeking to apply strong communication and interpersonal skills in fostering collaboration across departments to enhance compliance efforts and promote a culture of integrity within the organization.

-

Experienced AML Officer with a passion for continuous improvement and staying abreast of industry trends, aiming to drive innovative solutions that strengthen the organization's AML framework and enhance overall risk management strategies.

Looking to enhance your career as a 3D designer? Check out our comprehensive guide on creating a standout 3D Designer Resume that showcases your skills and attracts potential employers.

Example Summary for AML Officer Resume

This section provides a concise example of a resume summary tailored for an AML Officer position, highlighting key skills, relevant experience, and qualifications to attract potential employers effectively.

Detail-oriented and motivated recent graduate with a strong foundation in finance and compliance, seeking an entry-level position as an AML Officer. Proficient in analyzing financial transactions and identifying potential risks, with a keen understanding of regulatory requirements and anti-money laundering protocols. Excellent problem-solving skills and a commitment to upholding ethical standards. Eager to contribute to a dynamic team and support the organization's efforts in maintaining compliance and safeguarding against financial crime.

Detail-oriented and results-driven AML Officer with over 5 years of experience in anti-money laundering compliance and risk assessment. Proven track record in conducting thorough investigations, analyzing complex financial transactions, and implementing effective monitoring systems to mitigate risks. Strong knowledge of regulatory requirements and industry best practices, with excellent analytical and problem-solving skills. Adept at collaborating with cross-functional teams to enhance compliance programs and ensure adherence to legal standards. Committed to maintaining the integrity of financial institutions while safeguarding against illicit activities.

Results-driven AML Officer with over 10 years of experience in anti-money laundering compliance and risk management. Proven expertise in conducting complex investigations, implementing robust compliance programs, and ensuring adherence to regulatory requirements. Skilled in analyzing financial transactions, identifying suspicious activities, and collaborating with law enforcement agencies. Strong knowledge of AML regulations, KYC processes, and transaction monitoring systems. Adept at training teams on compliance protocols and fostering a culture of integrity and accountability. Committed to safeguarding organizational assets and enhancing the overall compliance framework.

Similar Resumes

Key Job Duties & Responsibilities of AML Officer

An AML Officer ensures compliance with anti-money laundering regulations, conducts risk assessments, monitors transactions for suspicious activity, and collaborates with law enforcement to prevent financial crimes and protect the organization.

-

Conducting Customer Due Diligence (CDD): Perform thorough assessments of customers and transactions to identify potential risks and ensure compliance with AML regulations.

-

Monitoring Transactions: Regularly analyze and monitor financial transactions for suspicious activities, patterns, or anomalies that may indicate money laundering or terrorist financing.

-

Reporting Suspicious Activities: Prepare and file Suspicious Activity Reports (SARs) to the appropriate authorities when suspicious activities are detected, ensuring timely and accurate reporting.

-

Risk Assessment: Evaluate and assess the organization’s risk exposure related to money laundering and terrorist financing, implementing necessary controls to mitigate risks.

-

Policy Development: Assist in the development, implementation, and maintenance of AML policies and procedures to ensure compliance with relevant laws and regulations.

-

Training and Awareness: Conduct training sessions for employees on AML policies, procedures, and best practices to enhance awareness and compliance within the organization.

-

Collaboration with Regulatory Bodies: Liaise with regulatory authorities and law enforcement agencies during investigations and audits, providing necessary documentation and support.

-

Internal Audits: Participate in internal audits and assessments of AML programs to evaluate their effectiveness and recommend improvements as needed.

-

Data Analysis: Utilize data analytics tools to identify trends and anomalies in transactions that may indicate potential money laundering activities.

-

Keeping Updated with Regulations: Stay informed about changes in AML regulations, industry trends, and best practices to ensure ongoing compliance and effectiveness of AML programs.

Important Sections to Add in AML Officer Resume

An AML Officer resume should include key sections such as professional summary, relevant experience, certifications, skills, and education. Highlighting these areas showcases expertise in anti-money laundering and compliance, enhancing appeal to potential employers.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Make it easy for potential employers to reach you.

-

Professional Summary: A brief overview of your qualifications, highlighting your experience in anti-money laundering (AML) compliance, risk management, and relevant certifications.

-

Skills: List key skills relevant to AML, such as knowledge of AML regulations, risk assessment, transaction monitoring, and investigative techniques.

-

Certifications: Include any relevant certifications, such as Certified Anti-Money Laundering Specialist (CAMS), Certified Fraud Examiner (CFE), or other industry-recognized credentials.

-

Professional Experience: Detail your work history, focusing on roles related to AML. Use bullet points to highlight accomplishments, responsibilities, and specific contributions to compliance programs.

-

Education: Mention your educational background, including degrees and relevant coursework. Highlight any special training related to AML or financial regulations.

-

Technical Proficiencies: List software and tools you are proficient in, such as AML monitoring systems, data analysis tools, and compliance management software.

-

Achievements: Showcase any awards, recognitions, or successful projects that demonstrate your effectiveness as an AML officer.

-

Professional Affiliations: Include memberships in relevant organizations, such as the Association of Certified Anti-Money Laundering Specialists (ACAMS), to show your commitment to the field.

-

References: Optionally, state that references are available upon request to provide credibility and support for your application.

Required Skills for AML Officer Resume

When crafting your AML Officer resume, highlight essential skills that showcase your expertise in compliance, risk assessment, and analytical thinking. These abilities are crucial for effectively detecting and preventing money laundering activities in today’s financial landscape.

- Knowledge of AML Regulations

- Risk Assessment

- Transaction Monitoring

- Investigative Skills

- Data Analysis

- Attention to Detail

- Report Writing

- Regulatory Compliance

- Communication Skills

- Financial Crime Awareness

- Customer Due Diligence

- Problem-Solving Skills

- Team Collaboration

- Time Management

- Technical Proficiency in AML Software

Action Verbs to Use in AML Officer Resume

Incorporating strong action verbs in an AML Officer resume enhances its impact, showcasing your skills and achievements effectively. These dynamic words convey your proactive approach, illustrating your ability to combat financial crimes and ensure regulatory compliance.

- Analyzed

- Investigated

- Monitored

- Assessed

- Detected

- Reported

- Collaborated

- Evaluated

- Implemented

- Ensured

- Advised

- Facilitated

- Coordinated

- Mitigated

- Recommended

Entry-Level AML Officer Resume Sample

Looking to kickstart your career in anti-money laundering? Check out this sample entry-level AML officer resume, designed to showcase your skills and potential, helping you stand out to employers in the financial sector.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, ZIP

Email: [email protected]

Phone: (123) 456-7890

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented and motivated individual seeking an entry-level AML Officer position to leverage analytical skills and a strong understanding of compliance regulations in a dynamic financial institution.

Education

Bachelor of Science in Finance

University of ABC, City, State

Graduated: May 2023

- Relevant Coursework: Financial Regulations, Risk Management, Anti-Money Laundering Compliance

Certifications

- ACAMS Certified Anti-Money Laundering Specialist (CAMS) – Expected Completion: December 2023

- Anti-Money Laundering Certificate – XYZ Training Institute, Completed: July 2023

Skills

- Knowledge of AML regulations and compliance frameworks

- Strong analytical and problem-solving skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Familiarity with AML software and investigative tools

- Excellent verbal and written communication skills

- Attention to detail and ability to work under pressure

Experience

Intern, Compliance Department

XYZ Bank, City, State

June 2022 - August 2022

- Assisted in conducting customer due diligence and enhanced due diligence reviews

- Supported the team in monitoring transactions for suspicious activities

- Prepared reports and documentation for regulatory compliance audits

- Participated in training sessions on AML policies and procedures

Volunteer, Financial Literacy Program

ABC Nonprofit, City, State

January 2021 - May 2022

- Educated community members on financial management and fraud prevention

- Developed materials to raise awareness about money laundering and its impacts

- Coordinated workshops that engaged participants in discussions about compliance

References

Available upon request.

AML Officer Sample Resume (Mid-Level)

Explore a comprehensive sample resume tailored for mid-level AML Officers, showcasing essential skills, qualifications, and experience. This resource serves as a valuable guide for crafting an impactful resume in the field of anti-money laundering.

Sample Resume #2

Contact Information

John Doe

123 Main Street

City, State, ZIP

Email: [email protected]

Phone: (123) 456-7890

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Detail-oriented and experienced Anti-Money Laundering (AML) Officer with over 5 years of expertise in compliance, risk assessment, and regulatory reporting. Proven track record in conducting investigations, implementing AML policies, and collaborating with law enforcement. Strong analytical skills and a commitment to maintaining the highest standards of integrity and compliance.

Core Competencies

- AML Compliance

- Risk Assessment

- Investigative Reporting

- Regulatory Knowledge

- Data Analysis

- Policy Development

- Training and Development

- Communication Skills

Professional Experience

Mid-Level AML Officer

ABC Bank, City, State

June 2020 – Present

- Conduct thorough investigations of suspicious transactions, resulting in a 30% increase in flagged cases leading to successful reporting.

- Collaborate with internal teams to enhance AML policies and procedures, ensuring compliance with federal and state regulations.

- Prepare and submit Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN).

- Train junior staff on AML practices and compliance requirements, fostering a culture of awareness and diligence.

AML Analyst

XYZ Financial Services, City, State

January 2018 – May 2020

- Analyzed customer transactions and account activity to identify potential money laundering risks.

- Assisted in the development and implementation of AML training programs for employees.

- Conducted risk assessments and contributed to the enhancement of the company’s AML framework.

- Maintained up-to-date knowledge of AML regulations and best practices, ensuring adherence to industry standards.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2017

Certifications

- Certified Anti-Money Laundering Specialist (CAMS)

- Anti-Money Laundering Certified Associate (AMLCA)

Professional Affiliations

- Association of Certified Anti-Money Laundering Specialists (ACAMS)

- International Compliance Association (ICA)

References

Available upon request.

AML Officer Sample Resume for Experienced Level

Looking for a senior-level AML officer resume format? This sample showcases essential skills and experiences, helping you highlight your expertise in anti-money laundering and compliance, making your application stand out to potential employers.

Sample Resume #3

Name

John Doe

Address

123 Main Street, City, State, Zip

Phone

(123) 456-7890

Email

[email protected]

LinkedIn

linkedin.com/in/johndoe

Professional Summary

Results-driven and detail-oriented Senior AML Officer with over 10 years of experience in anti-money laundering compliance and risk management. Proven track record in developing and implementing effective AML programs, conducting thorough investigations, and ensuring adherence to regulatory requirements. Exceptional analytical skills and a deep understanding of financial crime trends.

Core Competencies

- AML Compliance & Regulation

- Risk Assessment & Management

- Investigative Analysis

- Policy Development

- Training & Development

- Data Analysis & Reporting

- Stakeholder Engagement

- Financial Crime Prevention

Professional Experience

Senior AML Officer

ABC Financial Services, City, State

March 2018 – Present

- Lead the development and implementation of the AML program, ensuring compliance with federal and state regulations.

- Conduct complex investigations into suspicious activities, preparing detailed reports for regulatory agencies.

- Collaborate with cross-functional teams to enhance AML policies and procedures, resulting in a 30% increase in detection rates of suspicious transactions.

- Train staff on AML compliance and best practices, fostering a culture of compliance within the organization.

AML Compliance Analyst

XYZ Bank, City, State

June 2013 – February 2018

- Monitored and analyzed transaction data to identify potential money laundering activities, escalating issues as necessary.

- Assisted in the development of risk assessment methodologies to evaluate client risk profiles.

- Prepared and submitted Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN).

- Engaged with regulatory bodies during audits and examinations, ensuring all documentation was accurate and up-to-date.

Education

Bachelor of Science in Finance

University of City, City, State

Graduated: May 2013

Certifications

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Crime Specialist (CFCS)

Professional Affiliations

- Association of Certified Anti-Money Laundering Specialists (ACAMS)

- Financial Crimes Enforcement Network (FinCEN)

Technical Skills

- AML Monitoring Software (e.g., Actimize, SAS)

- Microsoft Office Suite (Excel, Word, PowerPoint)

- Data Visualization Tools (Tableau, Power BI)

References

Available upon request.

Resume Tips That Work for AML Officer Resume

Do

Do: Highlight relevant certifications such as CAMS or CFE to showcase your expertise in anti-money laundering practices and compliance standards.

Do: Detail your experience with risk assessment by explaining how you identified and mitigated potential money laundering threats in previous roles.

Do: Emphasize your knowledge of regulations including the Bank Secrecy Act and FATF guidelines to demonstrate your understanding of the legal framework governing AML efforts.

Do: Showcase your analytical skills by providing examples of how you analyzed transactions and flagged suspicious activities, contributing to effective investigations.

Do: Include your proficiency in AML software to illustrate your technical capabilities in using tools for monitoring, reporting, and compliance management.

Don't

Don't: Include irrelevant work experience. Focus on roles that directly relate to anti-money laundering and compliance to showcase your expertise.

Don't: Use jargon or overly technical language. Ensure your resume is accessible and understandable to a broad audience, including hiring managers who may not be specialists in AML.

Don't: Neglect quantifiable achievements. Highlight specific metrics or accomplishments in previous roles to demonstrate your effectiveness and impact in AML compliance.

Don't: Overlook the importance of formatting. Use a clean, professional layout that enhances readability and makes key information easily accessible.

Don't: Forget to tailor your resume for each application. Customize your resume to align with the specific requirements and keywords of the job description to increase your chances of getting noticed.

AML Officer Sample Cover Letter

A sample AML Officer cover letter provides a professional template showcasing key skills, experience, and qualifications, helping applicants craft compelling applications that highlight their suitability for anti-money laundering roles and stand out to employers.

Dear [Hiring Manager's Name],

I am writing to express my interest in the AML Officer position at [Company Name]. With a strong background in anti-money laundering compliance and a proven track record of identifying and mitigating financial crime risks, I am excited about the opportunity to contribute to your team.

In my previous role at [Previous Company Name], I successfully implemented rigorous monitoring systems that enhanced our ability to detect suspicious activities. My expertise in regulatory compliance has equipped me with the knowledge needed to navigate complex legal frameworks and ensure adherence to industry standards. I am adept at conducting thorough investigations and preparing detailed reports that support decision-making processes.

I am particularly drawn to [Company Name] due to its commitment to maintaining the highest ethical standards in the financial sector. I am eager to bring my analytical skills and attention to detail to your organization, helping to safeguard its reputation and integrity.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

FAQs about AML Officer Resume

What key skills should be highlighted on an AML Officer resume?

Highlight skills such as knowledge of anti-money laundering regulations, risk assessment, investigative techniques, attention to detail, analytical thinking, and proficiency in compliance software. Strong communication, problem-solving abilities, and teamwork are also essential, showcasing your capability to navigate complex financial environments effectively.

How can I demonstrate my experience with compliance regulations on my AML Officer resume?

Highlight your experience by detailing specific compliance regulations you’ve worked with, such as BSA, OFAC, or FinCEN. Include quantifiable achievements, like successful audits or training programs implemented. Use action verbs to describe your role in ensuring adherence to these regulations, showcasing your expertise and commitment to compliance.

What certifications are beneficial to include on an AML Officer resume?

Including certifications such as Certified Anti-Money Laundering Specialist (CAMS), Certified Financial Crime Specialist (CFCS), and Anti-Money Laundering Certified Associate (AMLCA) can significantly enhance your AML Officer resume. These credentials demonstrate your expertise, commitment to the field, and understanding of compliance regulations, making you a more attractive candidate.

How should I format my AML Officer resume for maximum impact?

To maximize impact, format your AML Officer resume with a clean, professional layout. Use clear headings, bullet points for key achievements, and a concise summary. Tailor your content to highlight relevant skills and experiences, ensuring it aligns with the job description to capture attention effectively.

What accomplishments should I showcase to stand out as an AML Officer candidate?

Highlight your expertise in regulatory compliance, successful investigations of financial crimes, and proficiency in risk assessment. Showcase certifications like CAMS or CFE, and emphasize your contributions to enhancing AML programs, reducing fraud, and collaborating with law enforcement. Quantify achievements with metrics to demonstrate your impact effectively.

AML Officer Resume

Objective

Detail-oriented AML Officer with extensive experience in compliance and risk management. Seeking to leverage analytical skills and regulatory knowledge to enhance anti-money laundering efforts and protect organizational integrity.

Summary/Description

Detail-oriented AML Officer with 5+ years of experience in anti-money laundering compliance, risk assessment, and regulatory reporting. Proven track record in identifying suspicious activities and ensuring adherence to legal standards.

Top Required Skills

Regulatory Knowledge

Analytical Skills

Attention to Detail

Communication Skills

Risk Assessment

Mistakes to Avoid

Failing to highlight relevant certifications and training in anti-money laundering.

Omitting specific achievements or metrics that demonstrate effectiveness in previous roles.

Using generic language instead of industry-specific terminology and keywords.

Important Points to Add

Strong knowledge of AML regulations and compliance standards

Experience in conducting risk assessments and investigations

Proficiency in using AML software and data analysis tools

View More Templates

Free Resume Templates

Free Resume Templates