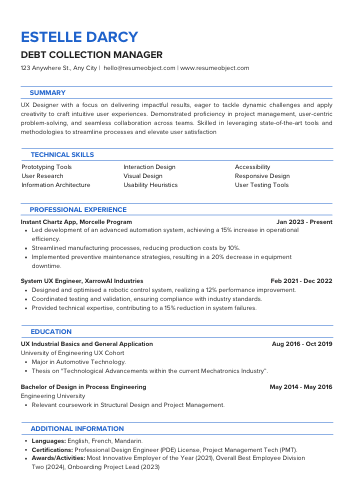

Debt Collection Manager Resume

In today's competitive job market, a well-crafted debt collection manager resume is essential for standing out among applicants. Utilizing a professional resume template can help you showcase your skills and experience effectively, increasing your chances of landing an interview.

A strong resume format highlights your expertise in debt recovery, negotiation, and compliance. By following a proven sample format, you can present your qualifications in a clear and compelling manner, making it easier for potential employers to recognize your value in the debt collection industry.

Debt Collection Manager Resume Objective Statement Examples

Explore effective resume objective examples for Debt Collection Managers, highlighting skills in negotiation, compliance, and team leadership to attract potential employers and demonstrate your value in managing collections efficiently.

-

Results-driven Debt Collection Manager with over 5 years of experience seeking to leverage expertise in optimizing collection processes to reduce delinquency rates and enhance cash flow for [Company Name].

-

Dedicated professional aiming to utilize strong leadership skills and a proven track record in team management to improve collection performance and foster a culture of accountability at [Company Name].

-

Detail-oriented Debt Collection Manager with a focus on implementing innovative strategies to enhance recovery rates and customer relationships, looking to contribute to the financial success of [Company Name].

-

Experienced in debt recovery and compliance, seeking to apply analytical skills and industry knowledge to streamline operations and minimize losses at [Company Name].

-

Strategic thinker with a passion for financial management, aiming to drive operational efficiency and achieve collection targets through effective team training and development at [Company Name].

Discover how to craft an impressive Microstrategy Architect Resume that highlights your skills and experience, helping you stand out in the competitive job market and secure your dream position.

Example Summary for Debt Collection Manager Resume

This section provides a concise example of a resume summary tailored for a Debt Collection Manager role, highlighting key skills, experience, and achievements that demonstrate suitability for the position.

Results-driven Debt Collection Manager with over 3 years of experience in optimizing collection processes and enhancing team performance. Proven track record in reducing delinquency rates and improving cash flow through effective strategies and strong leadership. Skilled in training and mentoring staff, analyzing collection data, and implementing best practices to maximize recovery rates. Adept at building relationships with clients to facilitate positive resolutions while ensuring compliance with regulations. Committed to achieving organizational goals and fostering a high-performance culture.

Results-driven Debt Collection Manager with over 7 years of experience in overseeing collections teams and implementing effective recovery strategies. Proven track record of improving collection rates by 30% through data analysis and process optimization. Skilled in building strong client relationships, negotiating settlements, and training staff to enhance performance. Adept at ensuring compliance with industry regulations while maintaining a customer-focused approach. Seeking to leverage expertise in a challenging role to drive operational excellence and maximize revenue recovery.

Results-driven Debt Collection Manager with over 10 years of experience in leading high-performing teams to optimize collections processes and improve recovery rates. Proven track record of implementing strategic initiatives that enhance operational efficiency and reduce delinquency. Expertise in negotiating payment plans, managing client relationships, and utilizing data analytics to drive decision-making. Strong leadership skills with a focus on training and mentoring staff to achieve organizational goals. Committed to compliance and ethical collection practices while ensuring customer satisfaction. Seeking to leverage extensive background in debt recovery and team management to contribute to a dynamic organization.

Similar Resumes

Key Job Duties & Responsibilities of Debt Collection Manager

Results-driven Debt Collection Manager with expertise in overseeing collection processes, optimizing recovery strategies, leading teams, and ensuring compliance with regulations to enhance financial performance and customer relationships.

-

Develop and implement collection strategies: Create effective collection plans to maximize recovery rates while minimizing costs.

-

Lead and manage the collections team: Supervise, train, and motivate team members to enhance performance and achieve targets.

-

Monitor collection performance metrics: Analyze key performance indicators (KPIs) to assess the effectiveness of collection efforts and identify areas for improvement.

-

Conduct regular team meetings: Facilitate discussions to share updates, address challenges, and celebrate successes within the team.

-

Establish and maintain relationships with clients: Build rapport with clients to foster open communication and encourage timely payments.

-

Negotiate payment arrangements: Work with clients to develop feasible payment plans that align with their financial situations.

-

Review and analyze accounts receivable: Assess outstanding debts and prioritize collections based on the age of accounts and potential recoverability.

-

Ensure compliance with laws and regulations: Stay updated on relevant debt collection laws and ensure all practices adhere to legal standards.

-

Collaborate with other departments: Work closely with sales, customer service, and legal teams to resolve disputes and improve overall collection processes.

-

Prepare and present reports: Generate regular reports on collection activities, performance metrics, and outstanding debts for senior management review.

-

Implement technology solutions: Utilize collection software and tools to streamline processes and improve efficiency.

-

Provide training and support: Equip team members with the necessary skills and knowledge to handle various collection scenarios effectively.

-

Handle escalated accounts: Address complex or high-value accounts that require specialized attention and negotiation skills.

-

Continuously improve collection processes: Identify and implement best practices to enhance the overall efficiency and effectiveness of the collections department.

Important Sections to Add in Debt Collection Manager Resume

Highlighting key sections in a Debt Collection Manager resume, such as relevant experience, skills, certifications, and achievements, is crucial for showcasing expertise and attracting potential employers in the competitive financial industry.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile to ensure potential employers can easily reach you.

-

Professional Summary: A concise overview of your experience and skills in debt collection management, highlighting your key achievements and what you bring to the table.

-

Skills: List relevant skills such as negotiation, communication, conflict resolution, and knowledge of debt collection laws and regulations. Tailor this section to match the job description.

-

Work Experience: Detail your previous roles in debt collection, emphasizing your responsibilities, achievements, and contributions to the organizations. Use quantifiable metrics to showcase your success, such as percentage of debts collected or reduction in outstanding accounts.

-

Education: Include your highest degree, relevant certifications, and any specialized training in debt collection or finance. This section establishes your qualifications.

-

Certifications: Mention any industry-specific certifications, such as Certified Collection Specialist (CCS) or Certified Credit and Collection Professional (CCCP), to demonstrate your commitment to the field.

-

Technical Proficiency: Highlight your familiarity with debt collection software, CRM systems, and any relevant tools that enhance your efficiency in managing accounts.

-

Professional Affiliations: List memberships in industry organizations, such as the Association of Credit and Collection Professionals (ACA), to showcase your engagement with the profession.

-

References: Optionally, include a statement that references are available upon request, or provide references if the job application requires them.

Required Skills for Debt Collection Manager Resume

When crafting your Debt Collection Manager resume, highlight essential skills that showcase your expertise in managing teams, negotiating effectively, and ensuring compliance. These abilities will set you apart and demonstrate your value to potential employers.

- Strong Communication Skills

- Negotiation Skills

- Problem-Solving Abilities

- Leadership Skills

- Time Management

- Customer Service Orientation

- Attention to Detail

- Analytical Skills

- Knowledge of Debt Collection Laws

- Financial Acumen

- Conflict Resolution

- Team Management

- Data Analysis

- Proficiency in Collection Software

- Emotional Intelligence

Action Verbs to Use in Debt Collection Manager Resume

Incorporating powerful action verbs in your Debt Collection Manager resume enhances its impact, showcasing your skills and achievements effectively. These dynamic words convey leadership, negotiation, and problem-solving abilities, making your application stand out to potential employers.

- Analyzed

- Negotiated

- Resolved

- Managed

- Coordinated

- Implemented

- Monitored

- Communicated

- Trained

- Enforced

- Optimized

- Streamlined

- Collaborated

- Documented

- Strategized

Entry-Level Debt Collection Manager Resume Sample

Looking to land your first role as a Debt Collection Manager? Check out this sample resume that highlights essential skills and experiences, helping you stand out and make a great impression on potential employers.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, Zip

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented and motivated professional seeking an entry-level Debt Collection Manager position to leverage strong communication skills and a background in finance to effectively manage collections and improve recovery rates.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2023

Relevant Experience

Collections Intern

ABC Financial Services, City, State

June 2022 – August 2022

- Assisted in managing accounts receivable, improving collection rates by 15% through effective communication with clients.

- Conducted research on delinquent accounts to develop tailored collection strategies.

- Maintained accurate records of customer interactions and payment arrangements in the company database.

Customer Service Representative

XYZ Corporation, City, State

January 2021 – May 2022

- Provided exceptional customer service by addressing inquiries and resolving issues related to billing and payments.

- Collaborated with the collections team to identify patterns in customer payment behavior and suggest improvements.

- Trained new staff on best practices for customer interaction and conflict resolution.

Skills

- Strong negotiation and communication skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Familiar with debt collection software (e.g., FICO, COGS)

- Excellent problem-solving abilities

- Knowledge of relevant regulations and compliance in debt collection

Certifications

Certified Collection Professional (CCP) – Expected completion: December 2023

References

Available upon request.

Debt Collection Manager Sample Resume (Mid-Level)

This sample mid-level debt collection manager resume showcases essential skills, experience, and achievements in debt recovery, team leadership, and compliance. It serves as a valuable reference for professionals seeking to advance their careers in debt management.

Sample Resume #2

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Debt Collection Manager with over 7 years of experience in improving collection processes and managing teams. Proven track record of increasing recovery rates and reducing delinquency. Skilled in developing effective strategies to enhance customer relationships while ensuring compliance with regulations.

Skills

- Debt Collection Strategies

- Team Leadership

- Regulatory Compliance

- Customer Relationship Management

- Data Analysis and Reporting

- Conflict Resolution

- Negotiation Skills

- Performance Metrics

Professional Experience

Debt Collection Manager

ABC Collections, City, State

June 2018 – Present

- Led a team of 15 collectors, achieving a 25% increase in recovery rates over two years.

- Developed and implemented training programs that improved team performance and compliance with industry regulations.

- Analyzed collection data to identify trends and optimize collection strategies, resulting in a 30% reduction in delinquency.

- Collaborated with legal teams to manage escalated accounts, ensuring adherence to laws and guidelines.

Senior Debt Collector

XYZ Financial Services, City, State

March 2015 – May 2018

- Successfully managed a portfolio of over 500 accounts, consistently meeting or exceeding collection targets.

- Established strong relationships with clients, leading to improved payment plans and higher recovery rates.

- Conducted detailed account analyses to identify risk factors and develop tailored collection strategies.

Debt Collection Agent

123 Collections, City, State

January 2013 – February 2015

- Handled inbound and outbound calls to collect on overdue accounts, achieving a 90% resolution rate.

- Maintained accurate records of customer interactions and payment agreements in the company database.

- Assisted in training new agents on effective collection techniques and compliance procedures.

Education

Bachelor of Arts in Business Administration

University of State, City, State

Graduated: May 2012

Certifications

- Certified Revenue Cycle Representative (CRCR)

- Fair Debt Collection Practices Act (FDCPA) Compliance Training

References

Available upon request.

Debt Collection Manager Sample Resume for Experienced Level

Looking for a standout resume format for a Senior-Level Debt Collection Manager? This sample highlights key skills, achievements, and experience, ensuring you make a lasting impression on potential employers in the competitive finance industry.

Sample Resume #3

John Doe

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

[LinkedIn Profile URL]

Professional Summary

Results-driven Debt Collection Manager with over 10 years of experience in managing collections teams and optimizing recovery processes. Proven track record in reducing delinquency rates and improving cash flow through strategic planning and effective communication. Strong analytical skills and expertise in debt recovery regulations.

Professional Experience

Senior Debt Collection Manager

XYZ Financial Services, City, State

January 2018 – Present

- Lead a team of 25 collectors, achieving a 30% reduction in overdue accounts within the first year.

- Developed and implemented new collection strategies that increased recovery rates by 40%.

- Conducted training sessions on compliance regulations and negotiation techniques, improving team performance.

- Collaborated with legal teams to ensure adherence to debt collection laws and regulations.

Debt Collection Supervisor

ABC Collections, City, State

June 2015 – December 2017

- Supervised a team of 15 collectors, consistently meeting monthly collection targets.

- Analyzed collection reports to identify trends and areas for improvement, resulting in a 25% increase in productivity.

- Established performance metrics and KPIs to evaluate team effectiveness and drive accountability.

- Fostered relationships with clients to negotiate payment plans and settlements, enhancing customer satisfaction.

Debt Collector

123 Recovery Agency, City, State

March 2012 – May 2015

- Managed a portfolio of accounts, achieving an average recovery rate of 85%.

- Utilized effective communication techniques to resolve disputes and negotiate payment arrangements.

- Maintained accurate records of all collection activities, ensuring compliance with industry regulations.

- Assisted in training new hires on company policies and collection best practices.

Education

Bachelor of Business Administration

University of State, City, State

Graduated: May 2011

Certifications

- Certified Credit and Collection Professional (CCCP)

- Debt Collection Compliance Certification

Skills

- Team Leadership

- Strategic Planning

- Compliance and Regulatory Knowledge

- Negotiation and Conflict Resolution

- Data Analysis and Reporting

- Customer Relationship Management

References

Available upon request.

Resume Tips That Work for Debt Collection Manager Resume

Do

Do: Highlight your experience in managing debt collection teams, emphasizing your leadership skills and ability to drive results through effective team management and motivation.

Do: Showcase your proficiency in debt recovery strategies, detailing specific methods you have implemented that led to increased recovery rates and improved cash flow for the organization.

Do: Demonstrate your knowledge of compliance regulations, illustrating your understanding of legal requirements and ethical practices in debt collection to ensure adherence and minimize risk for the company.

Do: Include metrics and achievements, such as percentage improvements in collection rates or reductions in days sales outstanding (DSO), to quantify your impact and effectiveness in previous roles.

Do: Emphasize your communication and negotiation skills, providing examples of how you effectively resolved disputes and maintained positive relationships with clients while achieving collection goals.

Don't

Don't: Include Irrelevant Work Experience - Focus only on roles that directly relate to debt collection or financial management to keep your resume concise and relevant.

Don't: Use Jargon or Technical Terms - Avoid industry-specific language that may confuse hiring managers; instead, use clear and straightforward language.

Don't: Neglect Quantifiable Achievements - Always highlight measurable successes, such as the percentage of debts collected or improvements in recovery rates, to demonstrate your effectiveness.

Don't: Ignore Formatting Consistency - Ensure that fonts, bullet points, and spacing are uniform throughout the document to present a professional appearance.

Don't: Overlook Keywords from the Job Description - Tailor your resume with specific keywords from the job listing to increase the chances of passing through applicant tracking systems.

Debt Collection Manager Sample Cover Letter

A sample debt collection manager cover letter provides a professional template showcasing key skills, experience, and qualifications to help applicants effectively demonstrate their suitability for the role and secure an interview.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Debt Collection Manager position at [Company Name]. With over [X years] of experience in debt recovery and a proven track record of improving collection rates, I am confident in my ability to contribute to your team.

In my previous role at [Previous Company Name], I successfully led a team that increased collections by 30% within one year. My hands-on approach to training and mentoring staff has fostered a motivated environment that prioritizes customer relations while ensuring compliance with industry regulations.

I am particularly drawn to [Company Name] because of your commitment to ethical collection practices and customer satisfaction. I believe my skills in negotiation and conflict resolution will align perfectly with your company’s values.

I look forward to the opportunity to discuss how I can help [Company Name] achieve its goals. Thank you for considering my application.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

FAQs about Debt Collection Manager Resume

What key skills should be highlighted on a Debt Collection Manager resume?

A Debt Collection Manager resume should highlight key skills such as strong communication, negotiation, and conflict resolution abilities. Additionally, emphasize analytical skills for data assessment, leadership experience for team management, knowledge of debt collection laws, and proficiency in relevant software to streamline processes and improve efficiency.

How can I demonstrate my experience in managing a debt collection team on my resume?

Highlight your leadership skills by detailing specific achievements, such as improving collection rates or reducing delinquency. Include metrics that showcase your team's performance, like percentage increases in recovered debts. Mention your experience with training, motivating staff, and implementing effective strategies to enhance team productivity and compliance.

What metrics or achievements should I include to showcase my success in debt collection?

Include metrics such as the percentage of debt recovered, average days to collect, reduction in delinquency rates, and successful negotiation outcomes. Highlight achievements like implementing efficient collection strategies, improving team performance, and exceeding collection targets to demonstrate your effectiveness and impact in debt collection management.

How should I format my Debt Collection Manager resume for maximum impact?

To format your Debt Collection Manager resume for maximum impact, use a clean, professional layout with clear headings. Prioritize relevant experience and skills, using bullet points for easy readability. Tailor your resume to highlight achievements in debt recovery and management, ensuring it aligns with the job description.

What industry-specific certifications or training should be mentioned in my resume?

Include certifications such as the Certified Collections Professional (CCP), Certified Revenue Cycle Representative (CRCR), or training in Fair Debt Collection Practices Act (FDCPA) compliance. Highlight any specialized training in negotiation, conflict resolution, or customer service to demonstrate your expertise and commitment to industry standards.

Debt Collection Manager Resume

Objective

Results-driven Debt Collection Manager with over 7 years of experience, skilled in optimizing recovery processes, leading teams, and enhancing client relationships to maximize collections and minimize delinquency rates.

Summary/Description

Results-driven Debt Collection Manager with over 7 years of experience in optimizing recovery processes, leading teams, and enhancing customer relations. Proven track record in achieving targets and reducing delinquency rates.

Top Required Skills

Communication Skills

Negotiation Skills

Leadership Abilities

Problem-Solving Skills

Financial Acumen

Mistakes to Avoid

Failing to highlight relevant experience in debt collection and management.

Omitting key skills such as negotiation, communication, and compliance knowledge.

Using generic language instead of quantifiable achievements and results.

Important Points to Add

Proven track record of reducing outstanding debt and improving collection rates

Strong leadership and team management skills

Expertise in compliance with debt collection laws and regulations

View More Templates

Free Resume Templates

Free Resume Templates