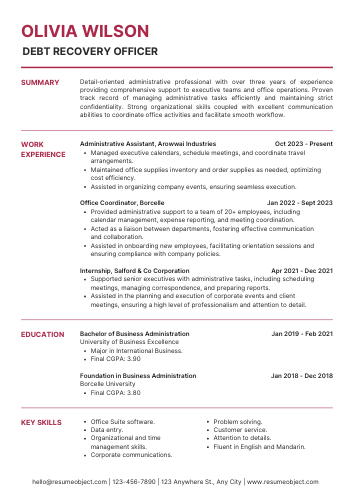

Debt Recovery Officer Resume

In today's competitive job market, a well-crafted Debt Recovery Officer resume is essential for standing out. This role requires a unique blend of skills, including effective communication and negotiation abilities, to recover outstanding debts efficiently.

Utilizing a resume template tailored for debt recovery positions can streamline the application process. By showcasing relevant experience and qualifications, candidates can demonstrate their expertise in debt collection strategies and financial management, increasing their chances of landing an interview.

Debt Recovery Officer Resume Objective Statement Examples

Explore effective resume objective examples for Debt Recovery Officers, highlighting skills in negotiation, communication, and financial analysis to attract potential employers and demonstrate commitment to successful debt recovery strategies.

-

Detail-oriented Debt Recovery Officer with over 5 years of experience in managing delinquent accounts and negotiating settlements, seeking to leverage expertise in collections to optimize recovery rates for [Company Name].

-

Results-driven professional specializing in debt recovery and customer relations, aiming to utilize strong communication skills and analytical abilities to enhance recovery processes at [Company Name].

-

Dedicated Debt Recovery Specialist with a proven track record of reducing outstanding debts by 30%, looking to contribute to [Company Name]'s financial success through effective negotiation and conflict resolution.

-

Experienced Debt Recovery Officer adept at utilizing data-driven strategies to improve collection efficiency, seeking to bring a proactive approach to [Company Name] in recovering overdue accounts.

-

Motivated collections professional with a strong focus on customer service and compliance, aiming to apply my skills in debt recovery and financial analysis to support [Company Name]'s goals in maintaining a healthy accounts receivable portfolio.

Discover how to create a standout resume that highlights your skills and experience in the dental insurance field. For expert guidance, check out our Dental Insurance Coordinator Resume resource today!

Example Summary for Debt Recovery Officer Resume

A Debt Recovery Officer resume summary highlights skills in negotiation, communication, and financial analysis, showcasing the candidate's ability to efficiently recover debts while maintaining positive client relationships and ensuring compliance.

Detail-oriented and motivated Debt Recovery Officer with a strong foundation in financial management and customer service. Proven ability to communicate effectively with clients to negotiate payment plans and resolve outstanding debts. Skilled in analyzing financial records and utilizing conflict resolution techniques to achieve positive outcomes. Committed to maintaining compliance with regulations while fostering strong relationships with clients to enhance recovery efforts. Eager to contribute to a dynamic team and support organizational goals in debt recovery.

Results-driven Debt Recovery Officer with over 5 years of experience in managing collections, negotiating payment plans, and resolving delinquent accounts. Proven track record of improving recovery rates through effective communication and relationship-building with clients. Skilled in analyzing financial data and implementing strategic debt recovery solutions. Committed to maintaining compliance with regulations while fostering positive customer interactions. Seeking to leverage expertise in a dynamic team to drive financial recovery and enhance overall organizational performance.

Results-driven Debt Recovery Officer with over 10 years of experience in managing high-volume accounts and implementing effective collection strategies. Proven track record of recovering over 95% of delinquent debts while maintaining positive client relationships. Skilled in negotiation, conflict resolution, and financial analysis, with a strong ability to assess risk and develop tailored repayment plans. Adept at utilizing advanced CRM systems and data analytics to optimize recovery processes. Committed to enhancing organizational profitability through strategic debt management and compliance with regulatory standards. Seeking to leverage expertise in a senior role to drive operational excellence and improve recovery outcomes.

Similar Resumes

Key Job Duties & Responsibilities of Debt Recovery Officer

A Debt Recovery Officer effectively manages outstanding debts, negotiates payment plans, maintains client relationships, and ensures compliance with regulations, contributing to the financial health of the organization.

-

Manage Debt Collection: Actively pursue outstanding debts through various communication methods, including phone calls, emails, and letters.

-

Assess Financial Situations: Evaluate the financial status of debtors to determine appropriate repayment plans and negotiate settlements.

-

Maintain Accurate Records: Keep detailed and accurate records of all communications, payment arrangements, and debtor interactions in the company’s database.

-

Conduct Credit Checks: Perform credit checks on potential clients to assess creditworthiness and make informed decisions regarding credit extension.

-

Develop Recovery Strategies: Create and implement effective debt recovery strategies tailored to different debtor profiles and situations.

-

Collaborate with Legal Teams: Work closely with legal departments to initiate legal proceedings when necessary and ensure compliance with relevant laws and regulations.

-

Provide Customer Support: Address inquiries and concerns from debtors regarding their accounts, providing clear and empathetic communication.

-

Monitor Payment Plans: Track progress on repayment plans, ensuring that debtors adhere to agreed terms and follow up on missed payments.

-

Report on Recovery Progress: Prepare regular reports on debt recovery performance, highlighting successes and areas for improvement.

-

Stay Updated on Industry Trends: Keep informed about changes in debt recovery practices, regulations, and industry standards to enhance effectiveness.

-

Train and Mentor Staff: Provide guidance and training to junior staff members on best practices in debt recovery and customer service.

-

Build Relationships: Foster positive relationships with clients and debtors to encourage timely payments and reduce the likelihood of future defaults.

Important Sections to Add in Debt Recovery Officer Resume

A Debt Recovery Officer resume should include key sections such as a professional summary, relevant work experience, skills, certifications, and education. Highlighting achievements and specific debt recovery strategies can enhance appeal to potential employers.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure this information is up-to-date and professional.

-

Professional Summary: A brief statement highlighting your experience, skills, and what you bring to the table as a Debt Recovery Officer. Tailor this section to reflect your strengths in debt collection and negotiation.

-

Key Skills: List relevant skills such as negotiation, communication, conflict resolution, financial analysis, and knowledge of debt recovery laws. Use bullet points for clarity.

-

Work Experience: Detail your previous employment in debt recovery or related fields. Include job titles, company names, and dates of employment. Focus on quantifiable achievements, such as the percentage of debts recovered or improvements in collection rates.

-

Education: Mention your educational background, including degrees, certifications, and relevant coursework. Highlight any specialized training in finance or debt recovery.

-

Certifications: Include any relevant certifications, such as Certified Credit and Collection Professional (CCCP) or similar credentials that demonstrate your expertise in the field.

-

Technical Skills: List any software or tools you are proficient in, such as debt recovery management systems, CRM software, or Excel, which can enhance your efficiency in the role.

-

Professional Affiliations: Mention any memberships in professional organizations related to finance or debt recovery, which can showcase your commitment to the industry.

-

References: Consider including a statement that references are available upon request, or list a few professional references if space allows.

Incorporating these sections will create a comprehensive and compelling resume that effectively showcases your qualifications as a Debt Recovery Officer.

Required Skills for Debt Recovery Officer Resume

When crafting your Debt Recovery Officer resume, highlight essential skills that showcase your ability to negotiate, communicate effectively, and manage challenging situations. These qualities will set you apart and demonstrate your value to potential employers.

- Communication Skills

- Negotiation Skills

- Problem-Solving Abilities

- Financial Acumen

- Attention to Detail

- Customer Service Orientation

- Time Management

- Conflict Resolution

- Knowledge of Debt Collection Laws

- Data Entry Proficiency

- Analytical Skills

- Empathy and Patience

- Organization Skills

- Team Collaboration

- Proficiency in Collection Software

Action Verbs to Use in Debt Recovery Officer Resume

Incorporating strong action verbs in your Debt Recovery Officer resume enhances its impact, showcasing your skills and achievements effectively. These dynamic words convey your proactive approach, problem-solving abilities, and commitment to achieving results in debt collection.

- Analyzed

- Negotiated

- Collected

- Resolved

- Communicated

- Investigated

- Documented

- Coordinated

- Facilitated

- Followed-up

- Implemented

- Reviewed

- Tracked

- Established

- Enhanced

Entry-Level Debt Recovery Officer Resume Sample

Looking to kickstart your career in debt recovery? Check out this sample entry-level resume that highlights essential skills, relevant experience, and a strong professional summary to help you stand out to potential employers.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, Zip

(123) 456-7890

[email protected]

Objective

Detail-oriented and motivated individual seeking an entry-level Debt Recovery Officer position to leverage strong communication skills and a passion for helping clients resolve financial issues.

Education

Bachelor of Arts in Business Administration

University of City, State

Graduated: May 2023

Relevant Skills

- Excellent verbal and written communication

- Strong negotiation and persuasion abilities

- Proficient in Microsoft Office Suite (Word, Excel, PowerPoint)

- Basic understanding of debt collection laws and regulations

- Strong analytical and problem-solving skills

- Customer-focused with a strong sense of empathy

Work Experience

Intern, Financial Services

ABC Financial Solutions, City, State

June 2022 – August 2022

- Assisted in the collection of overdue accounts by contacting clients via phone and email.

- Maintained accurate records of all communications with clients and payments received.

- Collaborated with team members to develop strategies for improving collection rates.

- Researched and analyzed client financial situations to provide tailored solutions.

Customer Service Representative

XYZ Retail, City, State

September 2021 – May 2022

- Provided exceptional customer service and resolved inquiries regarding billing and payments.

- Processed payments and managed customer accounts with accuracy.

- Developed strong relationships with customers, enhancing their overall experience.

Certifications

- Certified Collection Specialist (CCS) – Expected completion: December 2023

References

Available upon request.

Debt Recovery Officer Sample Resume (Mid-Level)

This sample mid-level debt recovery officer resume showcases essential skills, experience, and achievements in debt collection, negotiation, and customer relations, providing a comprehensive template for professionals seeking to advance their careers in financial recovery.

Sample Resume #2

Contact Information

John Doe

123 Main Street

City, State, Zip

Email: [email protected]

Phone: (123) 456-7890

Professional Summary

Detail-oriented Debt Recovery Officer with over 5 years of experience in managing collections, negotiating payment plans, and resolving disputes. Proven track record of reducing delinquency rates and improving cash flow. Skilled in building rapport with clients and utilizing effective communication strategies to achieve collection goals.

Experience

Debt Recovery Officer

XYZ Collections Agency, City, State

January 2020 – Present

- Managed a portfolio of over 300 accounts, achieving a 25% reduction in delinquency rates within the first year.

- Conducted thorough investigations to locate debtors and assess their financial situations.

- Negotiated payment plans with clients, resulting in a 40% increase in successful collections.

- Collaborated with legal teams to initiate litigation processes when necessary, ensuring compliance with regulations.

Collections Specialist

ABC Financial Services, City, State

June 2017 – December 2019

- Handled inbound and outbound calls to collect outstanding debts, maintaining a 90% call resolution rate.

- Developed and implemented follow-up strategies that improved collection rates by 15%.

- Provided exceptional customer service, addressing client inquiries and disputes effectively.

- Maintained accurate records of all communications and transactions in the database.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2017

Skills

- Debt Collection Strategies

- Negotiation and Persuasion

- Financial Analysis

- Customer Relationship Management (CRM)

- Legal Compliance in Collections

- Microsoft Office Suite

Certifications

- Certified Credit and Collection Professional (CCCP)

- Fair Debt Collection Practices Act (FDCPA) Compliance Training

References

Available upon request.

Debt Recovery Officer Sample Resume for Experienced Level

Looking for a standout Senior-Level Debt Recovery Officer resume? Our sample format highlights your expertise in collections, negotiation, and financial analysis, showcasing your skills to impress potential employers and land that dream job.

Sample Resume #3

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Results-driven Debt Recovery Officer with over 10 years of experience in managing debt collection processes and negotiating settlements. Proven track record of reducing delinquency rates and enhancing cash flow for organizations. Adept at building strong relationships with clients and utilizing effective communication skills to achieve financial recovery goals.

Core Competencies

- Debt Collection Strategies

- Negotiation & Settlement

- Client Relationship Management

- Regulatory Compliance

- Financial Analysis

- Conflict Resolution

- Data Analysis & Reporting

- Team Leadership

Professional Experience

Senior Debt Recovery Officer

ABC Financial Services, City, State

March 2018 – Present

- Developed and implemented effective debt recovery strategies, resulting in a 30% reduction in outstanding accounts.

- Negotiated payment plans with clients, increasing recovery rates by 25% through tailored solutions.

- Conducted regular training sessions for junior staff on best practices in debt collection and compliance.

- Analyzed financial data to identify trends and improve recovery processes and client engagement.

Debt Recovery Officer

XYZ Collections, City, State

June 2015 – February 2018

- Managed a portfolio of delinquent accounts, achieving a recovery rate of 40% through strategic outreach and negotiation.

- Established strong relationships with clients to facilitate timely payments and resolve disputes effectively.

- Collaborated with legal teams to prepare cases for litigation when necessary, ensuring compliance with all regulations.

- Maintained accurate records of all communications and transactions in the debt recovery system.

Debt Collection Agent

123 Credit Solutions, City, State

January 2012 – May 2015

- Handled inbound and outbound calls to collect overdue payments, consistently meeting monthly recovery targets.

- Provided exceptional customer service while addressing client inquiries and concerns related to their accounts.

- Assisted in the development of training materials for new hires, enhancing team performance and knowledge.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2011

Certifications

- Certified Credit and Collection Specialist (CCCS)

- Fair Debt Collection Practices Act (FDCPA) Compliance Training

Professional Affiliations

- Member, International Association of Credit and Collection Professionals (IACCP)

- Member, National Association of Retail Collection Attorneys (NARCA)

References

Available upon request.

Resume Tips That Work for Debt Recovery Officer Resume

Do

Do: Conduct thorough investigations to locate debtors and assess their financial situations, ensuring accurate information is gathered for effective recovery strategies.

Do: Communicate effectively with debtors through various channels, employing persuasive techniques to negotiate repayment plans that are mutually beneficial.

Do: Maintain detailed records of all interactions and transactions, ensuring compliance with legal regulations and company policies while tracking progress on debt recovery efforts.

Do: Collaborate with legal teams when necessary, preparing documentation and evidence for potential court actions to facilitate the recovery of outstanding debts.

Do: Stay updated on industry regulations and best practices, continually enhancing skills and knowledge to improve recovery rates and maintain ethical standards in debt collection.

Don't

Don't: Include irrelevant work experience – Focus on roles that demonstrate your skills in debt recovery, negotiation, and customer service to keep your resume targeted and concise.

Don't: Use jargon or overly complex language – Ensure your resume is clear and easily understandable; avoid industry-specific terms that may confuse hiring managers.

Don't: Neglect quantifiable achievements – Highlight specific results you’ve achieved, such as the percentage of debts recovered or the size of accounts managed, to showcase your effectiveness.

Don't: Ignore formatting and organization – Maintain a clean, professional layout with consistent fonts and bullet points to enhance readability and make a positive impression.

Don't: Forget to tailor your resume for each application – Customize your resume to align with the job description, emphasizing the skills and experiences that are most relevant to the position.

Debt Recovery Officer Sample Cover Letter

This sample debt recovery officer cover letter showcases essential skills and experience in managing collections, negotiating payments, and resolving disputes, effectively demonstrating the candidate's ability to contribute to a company's financial success and customer relations.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Debt Recovery Officer position at [Company Name], as advertised on [where you found the job listing]. With a strong background in debt recovery and a proven track record of achieving targets, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I successfully managed a portfolio of accounts, consistently recovering overdue payments while maintaining positive relationships with clients. My ability to communicate effectively and negotiate terms has resulted in a high recovery rate, significantly reducing outstanding debts. I am adept at analyzing financial information and developing strategies tailored to individual circumstances, ensuring optimal outcomes for both the company and its clients.

I am particularly impressed with [Company Name]'s commitment to ethical practices in debt recovery, and I share the belief that maintaining client trust is essential. I am excited about the opportunity to apply my skills in a reputable organization that values integrity and professionalism.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and dedication can contribute to the success of your team.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

FAQs about Debt Recovery Officer Resume

What key skills should be highlighted on a Debt Recovery Officer resume?

A Debt Recovery Officer resume should highlight key skills such as strong communication, negotiation, and problem-solving abilities. Proficiency in financial analysis, attention to detail, and familiarity with debt collection laws are essential. Additionally, showcasing experience with customer service and conflict resolution can enhance your candidacy.

How can I demonstrate my experience in debt collection on my resume?

Highlight specific achievements in debt collection, such as the percentage of debts recovered, successful negotiation strategies, and any relevant certifications. Use action verbs to describe your responsibilities, and include metrics to quantify your impact. Tailor your experience to align with the job description for a Debt Recovery Officer.

What certifications or qualifications are beneficial for a Debt Recovery Officer?

Certifications such as Certified Credit and Collection Specialist (CCCS) or Certified Revenue Cycle Representative (CRCR) are beneficial for Debt Recovery Officers. Additionally, qualifications in finance, business administration, or law can enhance understanding of debt recovery processes, improving effectiveness in negotiations and compliance with regulations.

How should I format my resume for a Debt Recovery Officer position?

Format your resume with a clear, professional layout. Use headings for sections like Contact Information, Summary, Skills, Experience, and Education. Tailor your content to highlight relevant skills such as negotiation and communication. Use bullet points for easy readability and ensure consistent font and spacing throughout.

What achievements should I include to make my Debt Recovery Officer resume stand out?

Include achievements such as successfully reducing outstanding debt by a percentage, improving recovery rates, implementing effective collection strategies, and exceeding monthly recovery targets. Highlight any awards received, training completed, or software proficiency that enhances your debt recovery skills, showcasing your impact and value to potential employers.

Debt Recovery Officer Resume

Objective

Detail-oriented Debt Recovery Officer with proven negotiation skills and a strong track record in collections. Seeking to leverage expertise in financial recovery and customer relations to enhance company revenue and client satisfaction.

Summary/Description

Results-driven Debt Recovery Officer with over 5 years of experience in collections, negotiation, and customer relations. Proven track record in reducing delinquency rates and enhancing recovery strategies for optimal results.

Top Required Skills

Negotiation Skills

Communication Skills

Problem-Solving Abilities

Financial Acumen

Customer Service Orientation

Mistakes to Avoid

Failing to highlight relevant experience in debt collection and recovery.

Neglecting to include specific achievements or metrics demonstrating success in previous roles.

Using generic language instead of tailored keywords related to debt recovery and financial negotiations.

Important Points to Add

Strong negotiation and communication skills

Proven track record in debt collection and recovery

Knowledge of relevant laws and regulations regarding debt recovery

View More Templates

Free Resume Templates

Free Resume Templates