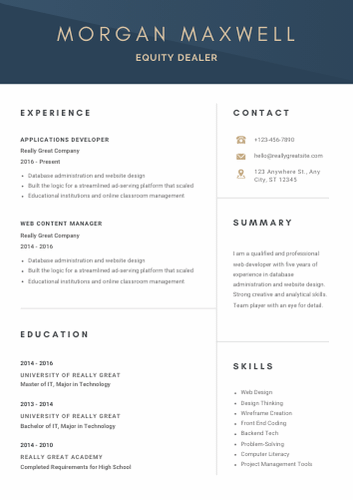

Equity Dealer Resume

In the competitive world of finance, an Equity Dealer plays a crucial role in executing trades and managing investment portfolios. Crafting a standout resume template is essential for showcasing your skills and experience in this dynamic field. A well-structured resume not only highlights your qualifications but also demonstrates your understanding of market trends and trading strategies.

Utilizing a professional sample format can significantly enhance your chances of landing an interview. By incorporating relevant keywords and emphasizing your achievements, you can create a compelling narrative that captures the attention of hiring managers. This guide will provide you with the tools needed to design an effective equity dealer resume that stands out in the job market.

Equity Dealer Resume Objective Statement Examples

Discover effective equity dealer resume objective examples that highlight your skills, experience, and passion for the financial markets, helping you stand out to potential employers and secure your desired position.

-

Results-driven Equity Dealer with over 5 years of experience in executing trades and managing client portfolios, seeking to leverage expertise in market analysis and risk management to enhance trading performance at a leading financial institution.

-

Dynamic Equity Dealer with a proven track record of achieving sales targets and maximizing client satisfaction, aiming to utilize strong analytical skills and market knowledge to contribute to a high-performing trading team.

-

Detail-oriented Equity Dealer skilled in developing and implementing trading strategies, looking to apply extensive knowledge of equity markets and client relationship management to drive revenue growth at a reputable brokerage firm.

-

Ambitious Equity Dealer with a strong foundation in financial analysis and investment strategies, eager to join a forward-thinking organization where I can utilize my skills in trade execution and market research to support client investment goals.

-

Proactive Equity Dealer with expertise in utilizing trading platforms and technology to optimize trade execution, seeking a challenging position where I can enhance operational efficiency and deliver exceptional service to clients.

For a standout application, explore our comprehensive Point of Sales Supervisor Resume guide. It offers essential tips and templates to showcase your skills and experience effectively.

Example Summary for Equity Dealer Resume

Discover a compelling resume summary tailored for an Equity Dealer role, highlighting key skills, experience, and achievements that showcase your expertise in trading, market analysis, and client relationship management.

Results-driven and detail-oriented finance graduate with a strong foundation in equity markets and investment strategies. Proven ability to analyze market trends and make informed trading decisions. Excellent communication and interpersonal skills, with a passion for building client relationships and providing exceptional service. Eager to leverage analytical skills and financial knowledge as an entry-level Equity Dealer to contribute to a dynamic trading team.

Results-driven Equity Dealer with over 5 years of experience in executing trades and managing client portfolios in fast-paced financial environments. Proficient in analyzing market trends and providing strategic investment advice to maximize returns. Strong background in risk management and compliance, ensuring adherence to regulatory standards. Excellent communication and negotiation skills, fostering long-term relationships with clients and stakeholders. Seeking to leverage expertise in equity trading and market analysis to contribute to a dynamic financial team.

Results-driven Equity Dealer with over 10 years of experience in executing high-volume trades and managing diverse investment portfolios. Proven track record of maximizing returns through strategic market analysis and risk assessment. Adept at building and maintaining client relationships, providing tailored investment advice, and leveraging market trends to inform trading strategies. Strong analytical skills complemented by a deep understanding of financial instruments and regulatory compliance. Committed to delivering exceptional service and achieving client financial goals in fast-paced trading environments.

Similar Resumes

Key Job Duties & Responsibilities of Equity Dealer

Equity Dealers execute trades, analyze market trends, provide investment advice, and manage client portfolios, ensuring optimal returns while adhering to regulatory standards and maintaining strong client relationships.

-

Market Analysis: Conduct thorough research and analysis of market trends, economic indicators, and financial news to identify potential investment opportunities.

-

Trade Execution: Execute buy and sell orders for stocks, bonds, and other securities on behalf of clients, ensuring timely and accurate transactions.

-

Client Consultation: Communicate with clients to understand their investment goals and risk tolerance, providing tailored advice and strategies based on their unique financial situations.

-

Portfolio Management: Monitor and manage client portfolios, making adjustments as necessary to optimize performance and align with market conditions.

-

Risk Assessment: Evaluate the risks associated with different investment options and ensure that clients are aware of potential losses and gains.

-

Compliance Adherence: Ensure all trading activities comply with regulatory requirements and internal policies, maintaining a high standard of ethical conduct.

-

Performance Reporting: Prepare and present detailed reports on portfolio performance, market trends, and investment strategies to clients on a regular basis.

-

Networking: Build and maintain relationships with clients, financial institutions, and other stakeholders to foster business growth and enhance service delivery.

-

Continuous Learning: Stay updated on industry developments, regulatory changes, and new financial products to provide informed advice and maintain a competitive edge.

-

Sales Skills: Utilize strong sales techniques to promote investment products and services, aiming to increase client acquisition and retention.

-

Team Collaboration: Work closely with other financial professionals, including analysts and advisors, to deliver comprehensive financial services to clients.

Important Sections to Add in Equity Dealer Resume

An effective Equity Dealer resume should include key sections such as a professional summary, relevant skills, work experience, education, certifications, and achievements, showcasing expertise in trading strategies, market analysis, and client relationship management.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Make it easy for potential employers to reach you.

-

Professional Summary: A brief overview of your experience, skills, and career objectives. Tailor this section to highlight your strengths as an equity dealer.

-

Core Competencies: List key skills relevant to equity trading, such as market analysis, risk management, portfolio management, and trading software proficiency.

-

Work Experience: Detail your previous roles in the finance industry. Include job titles, company names, locations, and dates of employment. Focus on achievements and responsibilities that showcase your trading expertise.

-

Education: Provide information about your academic background, including degrees obtained, institutions attended, and graduation dates. Relevant certifications, such as CFA or Series 7, should be included here.

-

Technical Skills: Highlight any relevant software or tools you are proficient in, such as Bloomberg Terminal, MetaTrader, or Excel. This demonstrates your technical capability in the trading environment.

-

Achievements: Include any awards, recognitions, or notable accomplishments in your career. Quantifying your success with metrics (e.g., percentage of profit increase) can make this section more impactful.

-

Professional Affiliations: Mention any memberships in finance-related organizations or groups. This shows your commitment to the industry and ongoing professional development.

-

References: Consider adding a note that references are available upon request. This indicates your confidence in your professional relationships.

Required Skills for Equity Dealer Resume

When crafting your equity dealer resume, highlight essential skills that showcase your expertise in trading, market analysis, and client relations. These skills will make you stand out to potential employers in the competitive finance industry.

- Market Analysis

- Risk Management

- Financial Modeling

- Trading Strategies

- Portfolio Management

- Technical Analysis

- Fundamental Analysis

- Regulatory Compliance

- Client Relationship Management

- Negotiation Skills

- Data Interpretation

- Financial Reporting

- Communication Skills

- Attention to Detail

- Time Management

Action Verbs to Use in Equity Dealer Resume

Incorporating powerful action verbs in your Equity Dealer resume enhances clarity and impact, showcasing your skills and achievements effectively. This strategic choice captures the attention of hiring managers and demonstrates your proactive approach in the finance industry.

- Analyzed

- Executed

- Facilitated

- Negotiated

- Optimized

- Recommended

- Researched

- Strategized

- Traded

- Monitored

- Collaborated

- Advised

- Managed

- Developed

- Communicated

Entry-Level Equity Dealer Resume Sample

Looking to kickstart your career in finance? Check out this sample entry-level equity dealer resume that showcases essential skills, relevant experience, and a professional format to help you stand out to potential employers.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Motivated and detail-oriented finance graduate seeking an entry-level Equity Dealer position to leverage analytical skills and knowledge of financial markets to contribute to a dynamic trading team.

Education

Bachelor of Science in Finance

University of XYZ, City, State

Graduated: May 2023

- Relevant Coursework: Investment Analysis, Financial Markets, Portfolio Management, Derivatives Trading

- Dean's List (2021, 2022)

Skills

- Strong analytical and quantitative skills

- Proficient in Microsoft Excel and financial modeling

- Knowledge of trading platforms (e.g., Bloomberg, E*TRADE)

- Excellent communication and interpersonal skills

- Ability to work under pressure and meet tight deadlines

Experience

Intern, Equity Research Analyst

ABC Financial Services, City, State

June 2022 – August 2022

- Assisted in analyzing equity securities and preparing reports for senior analysts.

- Conducted industry research and competitor analysis to support investment recommendations.

- Collaborated with team members to develop investment strategies based on market trends.

Finance Intern

XYZ Investment Group, City, State

June 2021 – August 2021

- Supported the trading desk by monitoring market activity and updating trading systems.

- Prepared daily reports on market performance and investment opportunities.

- Assisted in the execution of trades and ensured compliance with regulatory requirements.

Certifications

- Bloomberg Market Concepts (BMC) Certification

- Financial Risk Manager (FRM) Level I (In Progress)

Extracurricular Activities

- Member, Finance Club, University of XYZ

- Volunteer, Local Non-Profit Organization (Financial Literacy Program)

References

Available upon request.

Equity Dealer Sample Resume (Mid-Level)

This sample mid-level equity dealer resume showcases essential skills, experience, and achievements relevant to equity trading. It emphasizes financial acumen, market analysis, and client relationship management, tailored for professionals seeking advancement in the finance industry.

Sample Resume #2

Contact Information

John Doe

123 Finance St.

New York, NY 10001

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Dynamic and results-driven Equity Dealer with over 5 years of experience in trading and investment management. Proven expertise in executing trades, analyzing market trends, and providing strategic investment advice. Adept at building strong client relationships and delivering exceptional service in fast-paced environments.

Skills

- Equity Trading

- Market Analysis

- Risk Management

- Client Relationship Management

- Financial Modeling

- Regulatory Compliance

- Trading Platforms (Bloomberg, Eikon)

- Data Analysis

Professional Experience

Equity Dealer

XYZ Investment Firm, New York, NY

June 2019 - Present

- Execute trades for high-net-worth clients, managing a portfolio worth over $50 million.

- Analyze market trends and economic data to inform trading strategies, resulting in a 15% increase in client portfolio returns.

- Develop and maintain strong relationships with clients, providing tailored investment advice and regular market updates.

- Collaborate with research teams to assess investment opportunities and risk factors.

Junior Equity Trader

ABC Financial Services, New York, NY

July 2016 - May 2019

- Assisted senior traders in executing trades and managing client portfolios.

- Conducted in-depth market research and analysis, contributing to the development of successful trading strategies.

- Monitored market conditions and provided timely updates to clients and management.

- Participated in client meetings to discuss investment strategies and market outlook.

Education

Bachelor of Science in Finance

University of New York, New York, NY

Graduated: May 2016

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate

- Financial Risk Manager (FRM)

Professional Affiliations

- Member, CFA Institute

- Member, New York Society of Security Analysts

References

Available upon request.

Equity Dealer Sample Resume for Experienced Level

Looking for a standout Senior-Level Equity Dealer resume? Our sample format showcases your expertise and achievements, helping you grab attention and highlight your skills effectively. Let’s make your application shine in this competitive field!

Sample Resume #3

Contact Information

John Doe

123 Main Street

City, State, Zip

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Dynamic and results-driven Equity Dealer with over 10 years of experience in capital markets and equity trading. Proven track record of executing high-volume trades, analyzing market trends, and developing strategic investment plans. Exceptional ability to manage risk and maximize profitability while maintaining compliance with regulatory standards.

Core Competencies

- Equity Trading

- Market Analysis

- Risk Management

- Portfolio Management

- Client Relationship Management

- Regulatory Compliance

- Financial Modeling

- Trading Strategies

Professional Experience

Senior Equity Dealer

ABC Investments, City, State

January 2018 – Present

- Execute equity trades on behalf of high-net-worth clients, managing a portfolio exceeding $500 million.

- Analyze market conditions and trends to develop and implement trading strategies that enhance portfolio performance.

- Collaborate with research teams to identify investment opportunities and provide clients with tailored recommendations.

- Maintain compliance with SEC regulations and internal policies, ensuring all trades are executed within legal frameworks.

- Train and mentor junior dealers, fostering a collaborative environment and enhancing team performance.

Equity Trader

XYZ Capital, City, State

June 2013 – December 2017

- Managed daily trading activities, executing trades for institutional clients and ensuring timely order fulfillment.

- Conducted thorough technical and fundamental analysis to inform trading decisions and mitigate risks.

- Developed and maintained strong relationships with clients, providing regular market updates and investment advice.

- Assisted in the development of proprietary trading algorithms that improved execution efficiency by 20%.

Junior Equity Trader

LMN Brokerage, City, State

August 2010 – May 2013

- Supported senior traders in executing trades and managing client accounts, gaining hands-on experience in the equity market.

- Monitored market news and economic indicators to assist in trading strategy formulation.

- Prepared daily reports on trading performance and market conditions for senior management review.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2010

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate

- FINRA Series 7 and Series 63 Licenses

Professional Affiliations

- Member, CFA Institute

- Member, National Association of Securities Dealers

References

Available upon request.

Resume Tips That Work for Equity Dealer Resume

Do

Do: Highlight Relevant Experience - Clearly outline your previous roles in equity trading or related fields, emphasizing your responsibilities and achievements to showcase your expertise.

Do: Showcase Analytical Skills - Detail your ability to analyze market trends, financial statements, and economic data, demonstrating how these skills have contributed to successful trading strategies.

Do: Emphasize Communication Skills - Illustrate your proficiency in conveying complex information clearly and effectively, as communication is key in discussing strategies and market insights with clients and team members.

Do: Include Certifications and Education - List any relevant certifications, such as CFA or Series 7, along with your educational background, to establish credibility and a strong foundation in finance.

Do: Quantify Achievements - Use specific metrics to describe your successes, such as percentage increases in portfolio performance or the number of successful trades, to provide concrete evidence of your capabilities.

Don't

Don't: Include irrelevant work experience - Focus on roles that directly relate to equity trading or finance to keep your resume concise and relevant.

Don't: Use jargon or technical terms without explanation - Avoid confusing potential employers with industry-specific language that they may not understand; clarity is key.

Don't: List duties instead of achievements - Highlight your accomplishments and the impact you made in previous roles rather than just listing your responsibilities.

Don't: Neglect formatting and readability - Ensure your resume is well-organized and easy to read; a cluttered layout can detract from your qualifications.

Don't: Forget to tailor your resume for each application - Customize your resume for each position to emphasize the skills and experiences that align with the specific job requirements.

Equity Dealer Sample Cover Letter

Discover a professional sample equity dealer cover letter that highlights key skills, experience, and enthusiasm for the role, helping you craft a compelling application to stand out in the competitive finance industry.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Equity Dealer position at [Company Name] as advertised. With a strong background in financial analysis and a proven track record in trade execution, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I successfully managed a diverse portfolio, consistently achieving above-market returns. My expertise in market trends and risk management has enabled me to make informed trading decisions that align with clients' investment goals. I am particularly drawn to [Company Name] because of its commitment to innovative trading strategies and client satisfaction.

I am eager to bring my skills in client relationship management and market analysis to your esteemed firm. I believe my proactive approach and dedication to excellence will make a significant impact on your trading operations.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and passion for equity trading align with the goals of [Company Name].

Sincerely,

[Your Name]

[Your Contact Information]

FAQs about Equity Dealer Resume

What key skills should be highlighted on an Equity Dealer resume?

An Equity Dealer resume should highlight key skills such as strong analytical abilities, excellent communication, in-depth market knowledge, risk management, and proficiency in trading platforms. Additionally, showcasing teamwork, negotiation skills, and a solid understanding of financial regulations can set candidates apart in this competitive field.

How can trading experience be effectively showcased in an Equity Dealer resume?

Highlight your trading experience by detailing specific achievements, such as successful trades, portfolio management, and risk assessment. Include metrics like percentage returns, assets managed, and relevant software proficiency. Use action verbs to convey impact, and tailor your resume to reflect the skills and experiences relevant to the equity dealer role.

What educational qualifications are essential for an Equity Dealer resume?

An Equity Dealer resume typically requires a bachelor's degree in finance, economics, or a related field. Additional qualifications such as certifications in securities trading, investment analysis, or financial markets can enhance your profile. Relevant internships or experience in trading environments are also highly beneficial.

How to tailor a resume for an Equity Dealer position in the finance industry?

To tailor your resume for an Equity Dealer position, highlight relevant financial skills, such as market analysis and trading strategies. Include quantifiable achievements, emphasize your understanding of equity markets, and showcase any certifications. Customize your summary to reflect your passion for trading and your ability to thrive in fast-paced environments.

What are common mistakes to avoid when creating an Equity Dealer resume?

Common mistakes to avoid when creating an Equity Dealer resume include using a generic format, neglecting to highlight relevant skills and achievements, failing to quantify results, and omitting industry-specific terminology. Additionally, avoid excessive jargon and ensure your resume is concise, well-organized, and tailored to the job description.

Equity Dealer Resume

Objective

Results-driven Equity Dealer with extensive market knowledge and strong analytical skills, seeking to leverage expertise in trading strategies and client relationship management to drive profitability and enhance investment performance.

Summary/Description

Results-driven Equity Dealer with 5+ years of experience in trading, market analysis, and client relationship management. Proven track record of maximizing profits and minimizing risks in fast-paced environments.

Top Required Skills

Market Analysis

Risk Management

Financial Modeling

Communication Skills

Negotiation Skills

Mistakes to Avoid

Failing to highlight relevant financial certifications and licenses.

Omitting quantifiable achievements in sales and trading performance.

Using generic language instead of industry-specific terminology.

Important Points to Add

Strong knowledge of financial markets and investment products

Proven track record of executing trades efficiently and accurately

Excellent analytical skills and ability to assess market trends

View More Templates

Free Resume Templates

Free Resume Templates