Payroll Job Description for Resume in 2026 – Key Duties, Responsibilities, Action Verbs

Payroll Job Description for Resume

Crafting a compelling payroll job description for your resume is essential in showcasing your expertise and attracting potential employers. This role is pivotal in any organization, as it ensures employees are paid accurately and on time while maintaining compliance with tax regulations and company policies. Understanding the key duties and responsibilities associated with payroll positions can significantly enhance your resume's effectiveness.

In this article, we will explore the essential components of a payroll job description for your resume, including crucial action verbs that highlight your skills. By presenting a clear and concise overview of your capabilities, you can make a lasting impression on hiring managers and elevate your chances of landing that desired position.

Payroll Job Description for Resume

Payroll refers to the process of calculating, distributing, and managing employee compensation, including wages, bonuses, and deductions. It plays a crucial role in ensuring employees are paid accurately and on time, which directly impacts employee satisfaction and retention. In various industries, payroll management must comply with legal regulations, tax obligations, and labor laws, making it a vital function for maintaining organizational integrity and financial health.

In terms of career levels, payroll professionals can work at entry, mid, or senior levels, with responsibilities ranging from data entry and payroll processing to strategic oversight and compliance management. The work environment typically involves collaboration with HR, finance, and management teams, often utilizing specialized software to streamline processes. As businesses grow, the demand for skilled payroll professionals continues to rise, highlighting the importance of this role in any organization.

How a Payroll Job Description Enhances Resume

A strong job description is crucial for a Payroll resume because it highlights the candidate's relevant skills and experiences, making it easier for recruiters to assess fit. Here’s why this section grabs recruiter attention:

-

Clarity and Focus: A well-defined job description provides clarity, showcasing specific payroll-related responsibilities and achievements that align with the job requirements.

-

Keyword Matching: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Including relevant keywords from the job description ensures your Payroll resume passes through these systems, increasing your chances of being noticed.

-

Demonstrating Achievements: Highlighting measurable impacts, such as improved payroll accuracy or reduced processing time, shows your contributions and effectiveness in past roles.

-

Relevance: Tailoring your Payroll resume to reflect the job description emphasizes your suitability for the position, making it easier for recruiters to see you as a strong candidate.

-

Measurable Impact: Quantifying your achievements with numbers provides tangible evidence of your capabilities, making your Payroll resume more compelling.

Incorporating these elements ensures your Payroll resume stands out and resonates with both recruiters and ATS.

Learn more about optimizing your resume by visiting our full guide on Trainer Job Description for Resume.

Payroll Job Description Examples

Entry Level Resume Job Description Examples

-

Payroll Assistant: Responsible for collecting and verifying employee time sheets, processing payroll data, and assisting in the preparation of payroll reports. Ensure compliance with company policies and regulations while maintaining confidentiality of sensitive information.

-

Junior Payroll Coordinator: Support the payroll department by inputting employee data, calculating wages, and handling payroll discrepancies. Assist in the maintenance of payroll records and provide excellent customer service to employees regarding payroll inquiries.

-

Payroll Clerk: Perform data entry for payroll processing, including updating employee information and tracking hours worked. Collaborate with HR to ensure accurate payroll deductions and contribute to the timely distribution of paychecks.

-

Entry-Level Payroll Specialist: Assist in the preparation and processing of payroll for a diverse workforce. Help with audits, resolve payroll-related issues, and ensure compliance with labor laws and regulations while maintaining a high level of accuracy.

-

Payroll Administrator Trainee: Learn the fundamentals of payroll processing, including calculating pay, processing deductions, and ensuring compliance with federal and state regulations. Provide support to the payroll team and gain hands-on experience in payroll software systems.

Mid-Level Resume Job Description Examples

-

Job Role: Payroll Specialist

Job Description: Responsible for processing payroll for a mid-sized organization, ensuring accurate and timely payment to employees. Collaborate with HR to maintain employee records, resolve payroll discrepancies, and ensure compliance with federal and state regulations. -

Job Role: Payroll Coordinator

Job Description: Oversee payroll operations, including data entry, payroll processing, and reporting. Work with finance to reconcile payroll accounts and assist in audits. Provide support to employees regarding payroll inquiries and maintain confidentiality of sensitive information. -

Job Role: Payroll Analyst

Job Description: Analyze payroll data to identify trends and discrepancies. Prepare payroll reports for management and assist in the development of payroll policies and procedures. Collaborate with IT to ensure payroll systems are functioning effectively and efficiently. -

Job Role: Payroll Administrator

Job Description: Manage the end-to-end payroll process for multiple states, ensuring compliance with local labor laws. Maintain payroll records and implement improvements to payroll processes. Serve as a point of contact for payroll-related questions from employees and management. -

Job Role: Payroll Tax Specialist

Job Description: Handle payroll tax calculations, filings, and compliance for the organization. Monitor changes in tax regulations and ensure timely payment of payroll taxes. Provide guidance and support during audits and collaborate with external tax advisors as needed.

Experienced Level Resume Job Description Examples

-

Payroll Manager: Responsible for overseeing the entire payroll process, ensuring accurate and timely payroll processing for all employees. Collaborate with HR to manage employee data, resolve payroll discrepancies, and ensure compliance with federal and state regulations.

-

Senior Payroll Specialist: Manage complex payroll calculations, including bonuses, overtime, and deductions. Provide support in payroll audits, maintain payroll records, and assist in implementing payroll software upgrades while training junior staff on best practices.

-

Payroll Analyst: Analyze payroll data for accuracy and consistency, preparing detailed reports for management. Work closely with the finance team to reconcile payroll accounts, assist in budgeting processes, and ensure adherence to labor laws and company policies.

-

Payroll Coordinator: Coordinate the payroll process from data collection to distribution of paychecks. Maintain employee records, process new hires and terminations, and serve as a point of contact for employee inquiries regarding payroll and benefits.

-

Payroll Administrator: Execute payroll processing for a diverse workforce, ensuring compliance with legal requirements. Monitor payroll systems for updates, assist in year-end processing, and provide exceptional customer service to employees regarding payroll-related issues.

List of 15 Key Duties of a Payroll

Managing payroll is a critical function in any organization, ensuring employees are compensated accurately and on time. Here are 15 key duties related to payroll:

- Process bi-weekly or monthly payroll.

- Maintain employee records and payroll data.

- Calculate wages, deductions, and overtime.

- Ensure compliance with tax regulations.

- Prepare and distribute paychecks or direct deposits.

- Handle payroll inquiries and resolve discrepancies.

- Update payroll software and systems.

- Administer employee benefits and deductions.

- Prepare payroll reports for management.

- Coordinate year-end payroll processing and tax forms.

- Maintain confidentiality of sensitive employee information.

- Assist with audits related to payroll and taxes.

- Monitor and implement payroll policies and procedures.

- Stay updated on changes in labor laws.

- Train staff on payroll processes and systems.

Key Responsibilities of a Payroll

When crafting your resume for a Payroll position, highlighting key responsibilities can showcase your expertise and attract potential employers. Here are some essential job responsibilities to consider:

-

Process Payroll Transactions

Manage and execute payroll transactions accurately and timely, ensuring compliance with federal, state, and local regulations. -

Maintain Payroll Records

Keep detailed and organized payroll records, including employee data, tax information, and compensation adjustments for auditing and reporting purposes. -

Calculate Deductions and Benefits

Determine and apply appropriate deductions for taxes, benefits, and garnishments, ensuring accurate employee compensation in each payroll cycle. -

Respond to Employee Inquiries

Address employee questions and concerns regarding payroll discrepancies, pay stubs, and tax withholdings, providing exceptional customer service and support. -

Prepare Payroll Reports

Generate and analyze payroll reports for management, highlighting trends, discrepancies, and compliance issues to aid in informed decision-making. -

Ensure Compliance

Stay updated on payroll laws and regulations, ensuring all payroll practices meet legal requirements and company policies to avoid penalties. -

Collaborate with HR and Finance

Work closely with HR and finance departments to synchronize payroll processes, employee benefits, and budgeting for accurate financial forecasting. -

Conduct Payroll Audits

Perform regular audits of payroll processes and records to identify and rectify errors, ensuring accuracy and compliance with internal controls.

Essential Skills to Highlight on Payroll Resume

When crafting a standout payroll resume, highlighting essential skills is crucial to demonstrate your expertise and suitability for the role. Here’s a list of vital skills to consider:

- Payroll Processing

- Tax Compliance

- Attention to Detail

- Data Entry

- Timekeeping Systems

- Reporting and Analysis

- Knowledge of Labor Laws

- Payroll Software Proficiency

- Confidentiality

- Problem-Solving

- Communication Skills

- Organizational Skills

- Team Collaboration

- Customer Service Orientation

- Multi-tasking

- Reconciliation

- Financial Reporting

- Audit Preparation

- Adaptability

- Technical Skills

Other Resume Job Descriptions

How to Quantify Achievements in Payroll Job Description

To effectively quantify achievements in a Payroll job description for your resume, focus on specific metrics and outcomes that highlight your contributions. Use numbers, percentages, and clear results to demonstrate your impact. Here’s how to do it:

-

Accuracy Rate: Achieved a 99% accuracy rate in payroll processing, reducing errors and enhancing employee satisfaction.

-

Timeliness: Processed payroll for 500+ employees on time every month, ensuring compliance with company deadlines and avoiding penalties.

-

Cost Savings: Identified and implemented a new payroll software that reduced processing costs by 20%, saving the company $15,000 annually.

-

Process Improvement: Streamlined payroll procedures, decreasing processing time by 30%, which allowed for more focus on strategic HR initiatives.

-

Compliance: Successfully managed payroll audits, maintaining a 100% compliance rate with federal and state regulations over three consecutive years.

-

Employee Support: Developed a payroll inquiry system that improved response time to employee questions by 50%, enhancing overall employee experience.

By quantifying your achievements, you not only showcase your skills but also provide tangible evidence of your value to potential employers.

Tips to Tailor Payroll Job Description for ATS

To create an effective Payroll job description for ATS, start by clearly defining the role's responsibilities. Use specific keywords related to payroll processing, compliance, and reporting, as these terms are often searched for in a Payroll Resume. Highlight essential tasks such as managing employee payroll, ensuring accuracy in calculations, and adhering to relevant laws and regulations.

Next, outline the qualifications required for the position. This should include educational background, certifications like CPP or FPC, and experience in payroll software. Incorporating industry-specific terminology will enhance the chances of your job description being recognized by ATS.

Finally, emphasize the skills that set candidates apart, such as attention to detail, analytical abilities, and strong communication skills. By focusing on these aspects, you’ll attract candidates who not only meet the technical requirements but also align with your company culture, ultimately leading to a more effective hiring process.

Action Verbs & Power Words for Payroll Job Description

When crafting your payroll resume, using impactful action verbs can significantly enhance your job descriptions and showcase your skills effectively. Here’s a list of powerful words to consider:

- Administered

- Audited

- Calculated

- Coordinated

- Delivered

- Ensured

- Executed

- Managed

- Monitored

- Processed

- Reconciled

- Reported

- Streamlined

- Tracked

- Verified

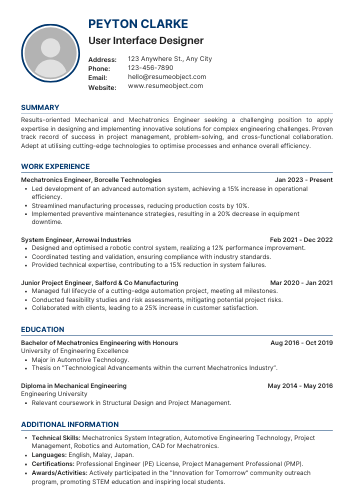

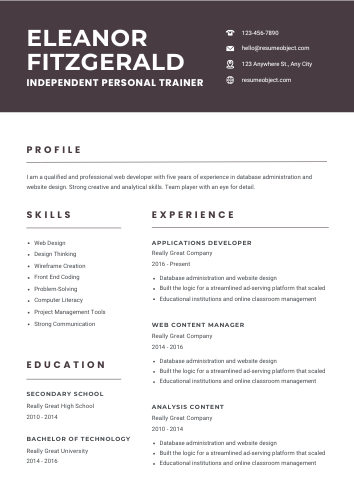

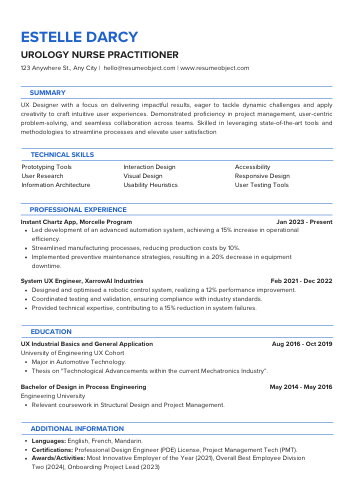

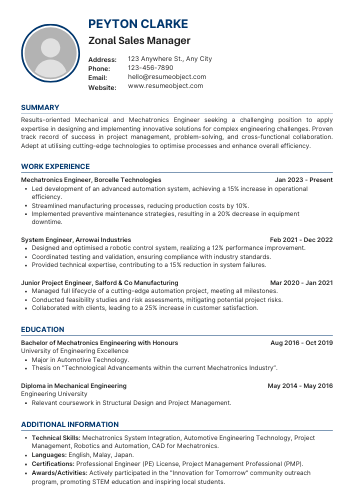

Sample Resume with Payroll Job Description

Following is the ATS-friendly sample resume of Payroll with job description with all necessary resume sections. Now have a look at Payroll Job Description for Resume.

John Doe

123 Main Street

Anytown, USA 12345

(555) 123-4567

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Detail-oriented payroll specialist with over 5 years of experience in managing payroll processes, ensuring compliance with federal and state regulations, and enhancing payroll systems. Seeking to leverage expertise in payroll management and employee relations at XYZ Corporation.

Professional Experience

Payroll Specialist

ABC Company, Anytown, USA

June 2019 – Present

- Processed bi-weekly payroll for over 500 employees, ensuring accuracy and compliance with federal and state regulations.

- Managed payroll-related inquiries, resolving issues promptly to maintain employee satisfaction.

- Assisted in the implementation of a new payroll software system, resulting in a 30% reduction in processing time.

- Collaborated with HR to ensure accurate reporting of employee hours, overtime, and deductions.

Payroll Coordinator

XYZ Solutions, Anytown, USA

January 2017 – May 2019

- Coordinated payroll activities for a diverse workforce, including hourly and salaried employees.

- Conducted audits of payroll reports to ensure accuracy and compliance with company policies.

- Developed training materials for new payroll staff, improving onboarding efficiency by 25%.

- Maintained employee records and processed changes in employment status, ensuring accuracy in payroll data.

Education

Bachelor of Science in Accounting

University of Anytown, Anytown, USA

Graduated: May 2016

Certifications

- Certified Payroll Professional (CPP) – American Payroll Association, 2018

- QuickBooks Certified User – Intuit, 2017

Skills

- Proficient in payroll software (ADP, Paychex, QuickBooks)

- Strong knowledge of payroll laws and regulations

- Excellent analytical and problem-solving skills

- Effective communication and interpersonal skills

- Detail-oriented with strong organizational abilities

Professional Affiliations

- Member, American Payroll Association

- Member, National Association of Accountants

References

Available upon request.

Common Mistakes to Avoid When Adding Payroll Job Description

When crafting a Payroll Job Description for Resume, it's crucial to avoid common pitfalls that can undermine your chances of landing an interview. A well-structured job description not only highlights your skills but also aligns with the expectations of hiring managers. Here are some mistakes to steer clear of:

- Vagueness: Failing to provide specific details about your responsibilities can make your experience seem less impressive.

- Irrelevant Information: Including unrelated job duties can distract from your payroll expertise and dilute the focus of your resume.

- Lack of Quantifiable Achievements: Not showcasing measurable outcomes, like reducing payroll errors by a certain percentage, misses the chance to demonstrate your impact.

- Ignoring Keywords: Not incorporating industry-specific keywords can hinder your resume's visibility in Applicant Tracking Systems (ATS).

- Poor Formatting: A cluttered or inconsistent format can make it difficult for hiring managers to read your resume effectively.

By avoiding these mistakes, you can create a compelling Payroll Job Description for Resume that showcases your qualifications and sets you apart from the competition. Remember, clarity and relevance are key to making a strong impression.

Do & Don't Do in Resume for Payroll Job Description

When crafting a Payroll job description for your Payroll Resume, focus on key responsibilities such as processing employee paychecks, managing payroll records, and ensuring compliance with tax regulations. Highlight skills like attention to detail, proficiency in payroll software, and strong analytical abilities. Use action verbs to convey your impact in previous roles, showcasing how you improved payroll accuracy or streamlined processes.

Additionally, include your experience with benefits administration and handling employee inquiries regarding payroll issues. Emphasize your ability to maintain confidentiality and work under tight deadlines. A well-rounded description not only enhances your Payroll Resume but also demonstrates your value to potential employers.

Do

Do: Process payroll accurately - Ensure timely and precise calculation of employee wages, bonuses, and deductions to maintain compliance with company policies and tax regulations.

Do: Maintain payroll records - Keep detailed and organized records of employee hours, pay rates, and deductions for auditing and reporting purposes.

Do: Resolve payroll discrepancies - Investigate and rectify any payroll-related issues or discrepancies reported by employees to ensure trust and satisfaction.

Do: Stay updated on payroll regulations - Continuously monitor changes in tax laws and labor regulations to ensure the payroll process adheres to current legal standards.

Do: Collaborate with HR and finance teams - Work closely with human resources and finance departments to integrate payroll processes with overall business operations and employee management systems.

Don't Do

Don't: Neglect compliance with labor laws and regulations. Ensuring adherence to federal, state, and local laws is crucial to avoid legal issues and penalties.

Don't: Overlook the importance of accurate data entry. Mistakes in payroll data can lead to incorrect payments, affecting employee trust and satisfaction.

Don't: Delay in processing payroll. Timely payroll is essential for maintaining employee morale and ensuring financial stability for staff.

Don't: Ignore the need for regular audits. Conducting periodic reviews of payroll processes helps identify discrepancies and improve overall accuracy.

Don't: Fail to communicate with employees regarding payroll issues. Open communication fosters transparency and helps resolve concerns quickly, enhancing employee relations.

Similar Job Roles & Titles

If you're exploring career opportunities related to the payroll profession, there are several similar job roles that share common responsibilities or skill sets. Here’s a list of 10 job titles:

- Payroll Specialist

- Payroll Administrator

- Payroll Manager

- Compensation Analyst

- HR Generalist

- Benefits Coordinator

- Financial Analyst

- Accounting Clerk

- Tax Specialist

- Human Resources Coordinator

FAQs about Payroll Resume Job Description

How detailed should the job description be on a Payroll resume?

The job description on a Payroll resume should be detailed enough to highlight relevant skills, responsibilities, and achievements, typically 3-5 bullet points focusing on key contributions and outcomes.

How can I make my Payroll job description stand out?

Highlight unique responsibilities, emphasize growth opportunities, showcase company culture, use engaging language, and include specific qualifications or skills that set your payroll position apart from others.

Can I include duties I performed outside the official Payroll title?

Yes, you can include duties performed outside your official payroll title, especially if they demonstrate relevant skills and experience that enhance your qualifications for the position you’re applying for.

How to handle limited experience in a Payroll job description?

Emphasize transferable skills, relevant coursework, and enthusiasm for learning. Highlight any related experience, even if indirect, and express a willingness to adapt and grow within the role.

What are the Key Duties of Payroll Job Role?

Key duties include processing payroll, maintaining employee records, ensuring compliance with tax laws, managing deductions, reconciling discrepancies, and preparing reports for management and audits.

Payroll Job Description for Resume

Discover how to craft an impactful Payroll Job Description for Resume with key duties, responsibilities, and action verbs. Enhance your resume and stand out to employers in the competitive job market.

Key Duties

Process employee payroll accurately

Maintain payroll records and documentation

Ensure compliance with tax regulations

Resolve payroll discrepancies and inquiries

Prepare payroll reports for management

Required Skills

Attention to Detail

Proficient in Payroll Software

Knowledge of Labor Laws

Strong Analytical Skills

Excellent Communication Skills

Mistakes to Avoid in Job Description

Vague job duties and responsibilities

Ignoring relevant skills and qualifications

Lack of measurable achievements

Tips for Job Description

Highlight relevant payroll software experience

Emphasize accuracy and attention to detail

Include compliance and regulatory knowledge

Free Resume Templates