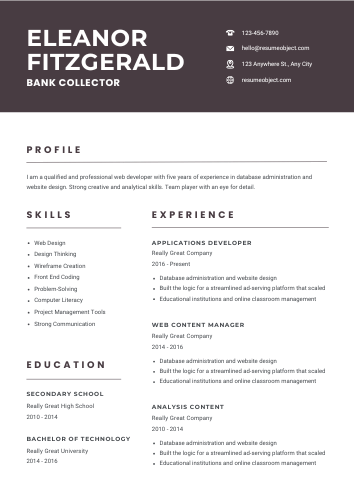

Bank Collector Resume

In today's competitive job market, a well-crafted bank collector resume is essential for standing out among applicants. A professional resume template can help you effectively showcase your skills, experience, and achievements, making it easier for hiring managers to recognize your potential.

Utilizing a sample format tailored for bank collectors allows you to highlight key qualifications such as communication skills and financial acumen. By following a structured approach, you can create a compelling resume that captures attention and increases your chances of landing an interview.

Bank Collector Resume Objective Statement Examples

Explore effective bank collector resume objective examples that highlight your skills, experience, and dedication to debt recovery, helping you stand out to potential employers in the financial sector.

-

Detail-oriented and results-driven bank collector seeking to leverage 5+ years of experience in debt recovery and customer relationship management to enhance collection efficiency and minimize delinquency rates.

-

Motivated bank collector aiming to utilize strong negotiation skills and a proven track record of meeting collection targets to contribute to the financial stability and growth of [Bank Name].

-

Experienced bank collector with a focus on building rapport with clients and resolving outstanding debts, seeking to apply expertise in financial compliance and customer service to improve collection processes.

-

Dedicated and proactive bank collector looking to utilize analytical skills and a customer-centric approach to optimize collection strategies and foster positive client relationships at [Bank Name].

-

Goal-oriented bank collector with a passion for helping clients achieve financial wellness, seeking to apply strong communication and problem-solving skills to effectively recover debts while maintaining customer satisfaction.

Discover how to create an impactful resume with our comprehensive guide. Enhance your chances of landing your dream job by following expert tips tailored for the role. Check out the Product Merchandiser Resume today!

Example Summary for Bank Collector Resume

This section provides a concise example of a resume summary tailored for a Bank Collector position, highlighting key skills, experiences, and attributes that make a candidate stand out in the role.

Detail-oriented and motivated recent graduate with a strong background in finance and customer service. Skilled in communication and problem-solving, with a proven ability to manage accounts and resolve discrepancies efficiently. Eager to leverage analytical skills and a passion for helping clients to contribute to a dynamic banking team as a Bank Collector. Committed to maintaining high standards of professionalism and integrity while achieving collection goals and enhancing customer satisfaction.

Results-driven Bank Collector with over 5 years of experience in debt recovery and customer relations. Proven track record of exceeding collection targets while maintaining strong relationships with clients. Skilled in negotiating payment plans and resolving disputes, ensuring compliance with regulatory standards. Adept at utilizing financial software and CRM systems to track accounts and streamline collection processes. Committed to enhancing customer satisfaction and contributing to the overall financial health of the organization.

Results-driven Bank Collector with over 10 years of experience in debt recovery and customer relationship management. Proven track record of reducing delinquency rates by implementing effective collection strategies and fostering positive client interactions. Skilled in negotiating payment arrangements and resolving disputes while maintaining compliance with regulatory standards. Adept at analyzing account data to identify trends and develop targeted solutions, resulting in increased recovery rates and enhanced customer satisfaction. Strong communicator with a focus on building rapport and trust, ensuring timely collections and long-term client retention. Seeking to leverage expertise in a challenging new role to contribute to organizational success.

Similar Resumes

Key Job Duties & Responsibilities of Bank Collector

Detail-oriented Bank Collector skilled in managing accounts, negotiating payment plans, and maintaining customer relationships to ensure timely collections while adhering to regulatory compliance and enhancing overall financial performance.

-

Contacting Debtors: Initiate communication with clients who have overdue accounts through phone calls, emails, or letters to remind them of their outstanding debts.

-

Negotiating Payment Plans: Work with debtors to establish feasible payment plans that accommodate their financial situation while ensuring the bank's interests are met.

-

Maintaining Accurate Records: Document all interactions with debtors and keep detailed records of payment agreements, collection activities, and account statuses.

-

Assessing Financial Situations: Evaluate the financial circumstances of debtors to determine the best course of action for debt recovery.

-

Conducting Skip Tracing: Utilize various methods to locate debtors who have moved or changed contact information without notifying the bank.

-

Educating Clients: Provide information on the consequences of non-payment and the importance of maintaining good credit to help clients understand their obligations.

-

Collaborating with Legal Teams: Work closely with legal departments to initiate proceedings for debt recovery when necessary, ensuring compliance with all relevant laws and regulations.

-

Reporting on Collection Activities: Prepare and submit regular reports on collection efforts, outcomes, and outstanding debts to management for review.

-

Adhering to Policies and Procedures: Follow all bank policies and regulatory requirements related to debt collection practices to maintain ethical standards.

-

Building Customer Relationships: Foster positive relationships with clients to encourage timely payments and improve overall customer satisfaction.

-

Staying Informed: Keep up-to-date with industry trends, regulations, and best practices in debt collection to enhance effectiveness in the role.

Important Sections to Add in Bank Collector Resume

Highlighting essential sections in a Bank Collector resume, such as contact information, professional summary, relevant experience, skills, and education, ensures a comprehensive presentation of qualifications, enhancing the chances of securing an interview in the competitive banking sector.

-

Contact Information: Include your full name, phone number, email address, and LinkedIn profile. Ensure this information is up-to-date for potential employers to reach you easily.

-

Professional Summary: Craft a concise summary highlighting your experience, skills, and career goals. This section should grab attention and provide a snapshot of your qualifications.

-

Skills: List relevant skills, such as negotiation, communication, problem-solving, and knowledge of collections software. Tailor this section to match the job description and emphasize your strengths.

-

Work Experience: Detail your previous roles in reverse chronological order. Include job titles, company names, locations, and dates of employment. Focus on achievements and responsibilities that demonstrate your effectiveness in collections.

-

Education: Provide information about your educational background, including degrees earned, institutions attended, and graduation dates. If you have relevant certifications, include them in this section.

-

Certifications and Licenses: Mention any industry-specific certifications, such as the Certified Collections Specialist (CCS) or other relevant licenses that enhance your qualifications.

-

Achievements: Highlight any awards, recognitions, or significant accomplishments in your career. Quantify your achievements whenever possible, such as percentage of debt recovered or reduction in delinquency rates.

-

Professional Affiliations: Include memberships in relevant organizations, such as the Association of Credit and Collection Professionals (ACA International). This demonstrates your commitment to the field and ongoing professional development.

-

References: While not always necessary, stating that references are available upon request can be beneficial. Be prepared to provide them when asked.

Required Skills for Bank Collector Resume

When crafting your bank collector resume, highlight essential skills that showcase your ability to communicate effectively, manage accounts, and resolve disputes. These qualities not only enhance your appeal but also demonstrate your value to potential employers.

- Strong Communication Skills

- Negotiation Skills

- Customer Service Orientation

- Attention to Detail

- Problem-Solving Abilities

- Time Management

- Financial Acumen

- Conflict Resolution

- Empathy and Patience

- Data Entry Proficiency

- Knowledge of Collection Laws

- CRM Software Proficiency

- Analytical Skills

- Team Collaboration

- Adaptability

Action Verbs to Use in Bank Collector Resume

Incorporating strong action verbs in your bank collector resume enhances its impact, showcasing your skills and achievements effectively. These verbs convey your proactive approach, emphasizing your ability to resolve issues, manage accounts, and drive collections successfully.

- Analyzed

- Negotiated

- Recovered

- Resolved

- Communicated

- Implemented

- Monitored

- Documented

- Collaborated

- Educated

- Facilitated

- Tracked

- Optimized

- Enforced

- Managed

Entry-Level Bank Collector Resume Sample

Looking to kickstart your career in banking? Check out this sample entry-level bank collector resume that highlights essential skills, experience, and qualifications to help you stand out and land that coveted position.

Sample Resume #1

Contact Information

John Doe

123 Main Street

City, State, Zip

(123) 456-7890

[email protected]

Objective

Motivated and detail-oriented individual seeking an entry-level Bank Collector position where I can utilize my strong communication skills and customer service experience to help recover outstanding debts and improve client relationships.

Education

Bachelor of Arts in Business Administration

University of Example, City, State

Graduated: May 2023

Skills

- Excellent verbal and written communication skills

- Strong problem-solving abilities

- Proficient in Microsoft Office Suite (Word, Excel, PowerPoint)

- Basic knowledge of debt collection regulations

- Ability to handle sensitive information with confidentiality

- Strong organizational skills and attention to detail

Experience

Customer Service Representative

Example Retail Store, City, State

June 2022 - Present

- Assisted customers with inquiries, complaints, and product returns, ensuring a high level of satisfaction.

- Maintained accurate records of customer interactions and transactions.

- Collaborated with team members to achieve sales goals and improve customer experience.

Intern

XYZ Financial Services, City, State

January 2023 - April 2023

- Supported the collections department by organizing client files and updating account statuses.

- Assisted in preparing reports on outstanding debts and collection efforts.

- Developed a basic understanding of debt collection processes and compliance regulations.

Certifications

- Certified Customer Service Professional (CCSP) - 2023

References

Available upon request.

Bank Collector Sample Resume (Mid-Level)

This sample mid-level bank collector resume showcases essential skills, experience, and achievements in debt recovery and customer relations, highlighting the candidate's ability to manage accounts effectively and contribute to the financial institution's success.

Sample Resume #2

Contact Information

John Doe

123 Main Street

City, State, ZIP

(123) 456-7890

[email protected]

LinkedIn: linkedin.com/in/johndoe

Objective

Dedicated and detail-oriented Bank Collector with over 5 years of experience in managing delinquent accounts and negotiating payment plans. Proven track record of improving collections rates and enhancing customer satisfaction. Seeking to leverage expertise in a mid-level collector position to contribute to organizational success.

Professional Experience

Bank Collector

ABC Bank, City, State

January 2020 – Present

- Managed a portfolio of 200+ delinquent accounts, achieving a 30% reduction in outstanding balances within the first year.

- Developed and implemented effective collection strategies that increased recovery rates by 25%.

- Conducted thorough account reviews and negotiations, resulting in tailored payment plans for clients, improving customer relationships.

- Collaborated with legal and compliance teams to ensure adherence to regulations and bank policies.

Collections Specialist

XYZ Financial Services, City, State

June 2017 – December 2019

- Handled inbound and outbound calls to collect overdue payments from customers, maintaining a professional and empathetic approach.

- Utilized collection software to track payments and account status, ensuring accurate records and reporting.

- Trained new hires on collection processes and best practices, enhancing team performance and efficiency.

- Assisted in the development of training materials and workshops for ongoing staff education.

Education

Bachelor of Arts in Finance

University of State, City, State

Graduated: May 2017

Skills

- Strong negotiation and communication skills

- Proficient in collection software (e.g., FICO, COGNOS)

- Knowledge of banking regulations and compliance

- Excellent problem-solving abilities

- Customer service-oriented mindset

Certifications

- Certified Collections Specialist (CCS)

- Fair Debt Collection Practices Act (FDCPA) Training

References

Available upon request.

Bank Collector Sample Resume for Experienced Level

Looking to showcase your experience as a senior-level bank collector? This resume sample format highlights your skills, achievements, and expertise, helping you stand out to employers seeking top-notch talent in the financial sector.

Sample Resume #3

John Doe

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

Professional Summary

Results-driven and detail-oriented Senior Bank Collector with over 10 years of experience in debt recovery and customer relationship management. Proven track record of reducing delinquency rates and enhancing customer satisfaction through effective communication and negotiation skills. Adept at utilizing collection software and maintaining compliance with regulatory guidelines.

Core Competencies

- Debt Recovery Strategies

- Customer Relationship Management

- Negotiation and Persuasion

- Regulatory Compliance

- Data Analysis and Reporting

- Team Leadership

- Conflict Resolution

- Time Management

Professional Experience

Senior Bank Collector

XYZ Bank, City, State

[Month, Year] – Present

- Managed a portfolio of over 500 delinquent accounts, achieving a 30% reduction in overdue balances within the first year.

- Developed and implemented effective collection strategies that improved recovery rates by 25%.

- Trained and mentored junior collectors, enhancing team performance and efficiency.

- Conducted regular audits to ensure compliance with federal and state regulations, resulting in zero compliance issues during audits.

- Utilized advanced collection software to track account status and generate reports for management review.

Bank Collector

ABC Financial Services, City, State

[Month, Year] – [Month, Year]

- Engaged with customers to negotiate payment plans, successfully collecting 85% of overdue accounts.

- Assisted in the development of training materials for new hires, focusing on effective collection techniques and compliance.

- Collaborated with legal teams to initiate collections on severely delinquent accounts, resulting in favorable outcomes for the bank.

- Maintained accurate records of all communications and transactions to ensure accountability and transparency.

Education

Bachelor of Science in Finance

University Name, City, State

[Month, Year]

Certifications

- Certified Collection Specialist (CCS)

- Fair Debt Collection Practices Act (FDCPA) Compliance Training

Professional Affiliations

- Member, American Collectors Association

- Member, National Association of Credit Management

References

Available upon request.

Resume Tips That Work for Bank Collector Resume

Do

Do: Highlight your collection achievements by quantifying your success in recovering debts, showcasing your ability to meet or exceed collection targets.

Do: Emphasize your communication skills as they are crucial for negotiating with clients and maintaining positive relationships while collecting overdue payments.

Do: Demonstrate your knowledge of financial regulations to assure potential employers that you understand compliance and ethical considerations in debt collection.

Do: Showcase your problem-solving abilities by providing examples of how you have effectively handled challenging situations with clients to secure payments.

Do: Include relevant software proficiency to indicate your ability to utilize collection management systems and CRM tools that enhance efficiency in your work.

Don't

Don't: Include irrelevant work experience - Focus on positions that highlight your skills in collections, finance, or customer service to keep your resume concise and relevant.

Don't: Use jargon or technical terms - Avoid industry-specific language that may confuse the reader; use clear and simple language to ensure your qualifications are understood.

Don't: Neglect to quantify achievements - Failing to provide specific metrics or results can weaken your impact; always include numbers to demonstrate your effectiveness in previous roles.

Don't: Make it too lengthy - Keep your resume to one page if possible; hiring managers often skim through resumes, so brevity is key to maintaining their attention.

Don't: Overlook proofreading - Spelling and grammatical errors can create a negative impression; always review your resume multiple times to ensure it is polished and professional.

Bank Collector Sample Cover Letter

A Sample Bank Collector Cover Letter provides a professional template to effectively communicate debt collection skills, demonstrate experience, and persuade banks or financial institutions of your suitability for a collector role.

Dear [Hiring Manager's Name],

I am writing to express my interest in the Bank Collector position at [Bank Name], as advertised on [Job Board/Company Website]. With a solid background in collections and customer service, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I successfully managed a portfolio of delinquent accounts, consistently achieving a collection rate of over 90%. My ability to communicate effectively with clients and negotiate payment plans has not only improved recovery rates but also enhanced customer satisfaction.

I am particularly drawn to this position at [Bank Name] because of your commitment to fostering strong customer relationships while maintaining financial integrity. I believe my skills in conflict resolution and my empathetic approach will align well with your values.

I am excited about the opportunity to bring my expertise in collections to [Bank Name] and help drive your success. Thank you for considering my application. I look forward to the possibility of discussing how I can contribute to your team.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

FAQs about Bank Collector Resume

What key skills should be highlighted on a Bank Collector resume?

Key skills to highlight on a Bank Collector resume include strong communication, negotiation, and problem-solving abilities. Proficiency in financial software, attention to detail, and knowledge of banking regulations are essential. Additionally, showcasing empathy, resilience, and the ability to handle difficult conversations can set you apart in this role.

How can experience in debt collection be effectively presented on a Bank Collector resume?

Highlight specific achievements, such as successful debt recovery rates and strategies used. Emphasize skills like negotiation, communication, and compliance with regulations. Use quantifiable metrics to showcase your impact, and tailor your experience to align with the bank's values and objectives to make your resume stand out.

What qualifications and certifications are essential for a Bank Collector resume?

Essential qualifications for a Bank Collector resume include a high school diploma or equivalent, with a preference for an associate's or bachelor's degree in finance or business. Certifications like the Certified Collection Specialist (CCS) or Credit and Collection Compliance (CCC) can enhance credibility and demonstrate expertise in the field.

How should a Bank Collector structure their resume to stand out to employers?

A Bank Collector's resume should highlight relevant skills such as communication, negotiation, and problem-solving. Use a clear format with sections for experience, education, and certifications. Quantify achievements, like debt recovery rates, and tailor the resume to the job description to demonstrate alignment with the employer's needs.

What common mistakes should be avoided when writing a Bank Collector resume?

Common mistakes to avoid when writing a Bank Collector resume include using vague language, neglecting relevant experience, failing to quantify achievements, and not tailoring the resume to the job description. Additionally, avoid excessive jargon and ensure proper formatting for clarity and professionalism. Proofread to eliminate errors.

Bank Collector Resume

Objective

Detail-oriented Bank Collector with strong negotiation skills and a proven track record in debt recovery. Seeking to leverage expertise in customer relations and financial management to enhance collections efficiency and client satisfaction.

Summary/Description

Detail-oriented Bank Collector with 5+ years of experience in debt recovery, customer relations, and negotiation. Proven track record of exceeding collection targets while maintaining positive client relationships. Strong communication skills.

Top Required Skills

Communication Skills

Negotiation Skills

Problem-Solving Skills

Attention to Detail

Time Management Skills

Mistakes to Avoid

Including irrelevant work experience unrelated to collections or finance.

Failing to highlight key skills such as negotiation, communication, and problem-solving.

Neglecting to quantify achievements, such as recovery rates or customer satisfaction scores.

Important Points to Add

Strong communication and negotiation skills

Proven track record of debt recovery and account management

Proficiency in financial software and CRM systems

View More Templates

Free Resume Templates

Free Resume Templates